Quoting figures from the Agencia para el Aceite de Oliva (Olive Oil Agency), the IOC highlights that this is well above the previous record of 1.41 million tons in 2003/04. The table olive harvest, meanwhile, is down 14 percent on last season, with just 519,310 tons so far netted.

Brazil: Olive Oil Imports Booming and Virgin Triumphing

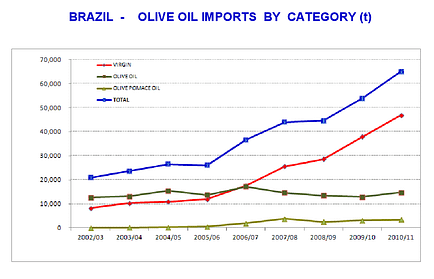

The IOC focused this month on Brazil, where it will soon launch a campaign to promote olives and olive oil. The country notched its all-time high for olive oil and olive pomace oil imports in 2010/11, topping 65,000 tons and up 21 percent on the season before — making 78 percent growth in five years.

More than 70 percent of total olive and pomace oil imported into Brazil last season was virgin olive oil (46,910 tons), 23 percent was olive oil grade and the rest was pomace. Portugal is Brazil’s main supplier, accounting for 55 percent of imports, followed by Spain with 26 percent, Argentina 11 percent and Italy 6 percent.

Brazil’s Table Olive Market: More than Forty Percent Growth in Five Years

Argentina dominates table olive sales to Brazil, supplying 75 percent of last season’s total imports of 65,218 tons, followed by Peru with 16 percent and the European Union with 9 percent. Brazil’s table olive imports have recorded 44% growth in the last five years, reaching a total of nearly 87,000 tons last season.

World Market: Chinese Imports Climb 20 Percent but Total Imports Down 1.7 Percent

For the first four months of the 2011/12 season (October-January), olive oil and olive pomace oil imports were up 20 percent in China, 10 percent in the U.S., and 8 percent in Brazil, compared to the same period last season, but down 18 percent in Canada and 10 percent in Australia.

While the January figures were not available at the time of writing, imports into Russia for October – December were up 35 percent. Figures for the same period for extra-EU and intra-EU imports show falls of 18 percent and 3 percent respectively.

Table Olives

Imports of table olives for October-January increased by 22 percent in Brazil and 4 percent in Canada but fell by 11 percent in the U.S. and 4 percent in Australia.

Olive Oil Producer Prices Plunge Again in Spain and Italy

After a slight upturn, extra virgin olive oil prices have slumped again in Spain and Italy but varied little in Greece. Compared with the same period a year ago, they are down 28 percent in Italy (€2.35/kg) 13 percent in Spain (€1.75/kg), and 3 percent in Greece (€1.84/kg).

Refined olive oil

The prices for refined oil in Spain and Italy are the lowest in the last three seasons. Over the last 12 months, they’ve fallen 5 percent in Spain (€1.66/kg) and 7 percent in Italy (€1.77/kg). Extra virgin olive oil is currently only about €0.08/kg more expensive than refined oil in Spain while in Italy it costs €0.58/kg more.

[gview file=“https://1.oliveoiltimes.com/library/ioc-march-2012-newsletter.pdf” height=“617”]