Is India Poised for an Edible Oils Revolution?

Globalization and digital connectivity have seen a shift in the mindset of urban India, promoting healthy eating and a balanced diet.

India is the second largest consumer of edible oil globally, with 70% of the demand met through imports, primarily palm oil, soybean, and sunflower oil. The shift towards healthier oils like MUFA and PUFA, such as olive oil, has been driven by an increase in per capita income and health awareness, but challenges in pricing remain for the Indian market.

At 24.20 million tons (mt) in 2016 – 17, and an estimated 23.95 mt in 2017 – 18, India’s edible oil consumption stands at number two globally, behind China (35 mt). Seventy percent (14 mt) of this demand is met through imports, comprised primarily of palm oil (9.5 mt), soybean (2.99 mt), and sunflower oil (1.54 mt). In fact, palm oil forms almost 40 percent of the total edible oil demand in India.

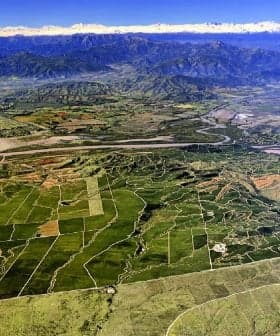

Vegetable oil has been an indispensable part of Indian households and kitchens, its origins traced to oil-seeds crushed in cold presses driven by bullock carts and larger mechanical presses. The various regions of India showed a proclivity for a particular type of seed, with the North and East cultivating mustard, the South cultivating sesame and coconut, and both the South and West cultivating groundnut. ‘Desi ghee,’ made from milk, was the other form of edible oil utilized primarily in sweets and food for special occasions.

As the Indian edible oil industry moved from hydrogenated vegetable oil to solvent-extracted and refined oil, there was a rapid growth in demand and corresponding acreage of oil-seeds. At their peak, domestic oil-seeds production stood at 21.5 mt in 1993 – 94, with India almost self-reliant. Post liberalization, however, there was a surge in imports, growing from 0.1 mt in 1993 – 94 to 14 mt in 2016 – 17.

Consumption patterns have shifted rapidly since then as well, as palm oil, soybean and sunflower oil have become the preferred vegetable oils in the country, while groundnut, mustard, sesame and other local oils still manage to retain some share regionally. Nowadays, the leading oils are primarily imported in crude form and refined in the country before being packaged and sold.

A quality-conscious Indian population has driven the sales of branded packaged goods across the country, with edible oil leading the way. Packaged edible oil currently stands at Rs 1.3 trillion ($19.5 billion) in 2017, with a share of over 30 percent of the Rs 4.34 trillion ($65 billion) packaged foods market. However, the per capita consumption still has potential to grow, with India at 17 kilograms (kg) against the global average of 25 kg.

According to the Global Burden of Disease report (Source — Institute for Health Metrics and Evaluation), 1.7 million Indians were killed by heart diseases in 2016, almost 10 percent of the global figure of 17.9 million. A study conducted by AIIMS and ICMR states that Indians under 30 are at risk from heart ailments. Numerous awareness campaigns about the risk of LDL cholesterol and cardiovascular disease have been launched by the government and health organizations.

An increase in per-capita income, as well as awareness, has seen India move from ‘loose’ edible oil to refined, packaged options. The next step in the evolution of Indian consumers has seen a larger focus on their and their family’s health. The urban Indian population, being well-traveled, digitally connected, and health-conscious, has started opting for healthier MUFA, i.e., monounsaturated fatty acids (olive oil, rice bran oil, canola oil, mustard oil, groundnut oil) and PUFA, i.e., polyunsaturated fatty acids (sunflower oil, safflower oil and corn oil).

Studies have shown that MUFAs lower the mortality rate from coronary heart disease (CHD), and lower the levels of total cholesterol and LDL cholesterol. These oils, particularly olive oil, also contain antioxidants that lower pain in joints and reduces the risk of Alzheimer’s and Parkinson’s. PUFA show strong cholesterol-lowering effects, along with improving insulin sensitivity. They also boost the immune system, improve skin quality and the functioning of the nervous system.

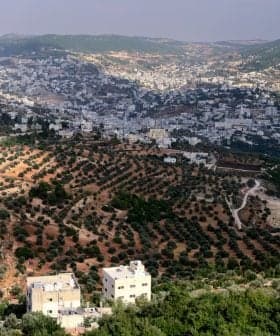

Olive oil, in particular, has been accepted in Indian households, and while the current import volume stands at approximately 13,000 tonnes (0.1 percent market share overall), there has been stable growth year on year. Introduction of extra-light olive oils with a high smoking point has been instrumental, as most Indian dishes involves cooking with high heat. In addition, dietary shifts towards healthier options like salads have seen an increase in the demand for extra virgin olive oil as well. Marketing initiatives, such as those by the EU and Asoliva have also aided awareness.

The biggest challenge remains pricing, as an increase in Indian import duties, appreciation of Euro against the Rupee, and higher product costs will result in a higher cost to the end consumer. The Indian Olive Association (IOA) has led a concerted effort to correct this pricing anomaly, citing the health benefits and lack of local competitors for imported olive oil in India.

The next step in this evolution of the Indian consumer is yet to be written, as the worlds second-most-populated country stands on the cusp of a health revolution that features healthier, medically recommended oils at its heart. It remains to be seen what steps the Indian government takes to support the positive momentum.