Trump's Tariffs Threaten Greek Olive Oil, Table Olives

President Trump’s 20 percent tariffs on food imports from the E.U. threaten the position of Greek olive oil and table olives in the American market, impacting exports and prices. The tariffs have been suspended for 90 days, but if reinstated, they could lead to Greek olive products becoming less competitive compared to other countries with lower tariffs.

The tariffs imposed by the Trump administration on imports of food products from the European Union to the United States threaten to overturn the established position of Greek olive oil and table olives in the American market.

Since April 9th, however, the so-called “reciprocal” tariffs have been suspended for 90 days.

The minimum ten percent tariff rate is still in place for products entering the U.S. from nearly every country, including E.U. member states.

As soon as the tariffs were announced, our sector started to look into ways for Greek olives to be exempted… We will have to wait until July when the 90-day tariff pause expires for any definitive results.

“The U.S. market is the top export destination of Greek bottled olive oil, along with Germany,” Yiorgos Mitrakos, the director of Sevitel, the association of Greek olive oil bottlers, told Olive Oil Times.

“The tariffs, if and when they come into force, will mean that olive oil exporters from other countries, such as Turkey, which are hit with only a ten-percent import tariff, could seize the opportunity to increase their share in the American market.”

Mitrakos added that, even if the Trump administration reinstates the 20 percent tariffs on E.U. products, American consumers who want to purchase Greek bottled olive oil will still pay less than they did last year, since prices have decreased this year.

See Also:Tunisia Seeks Trade Deal to Avert 28 Percent Export Tariff“Nevertheless, there is always a window for negotiations to abolish the tariffs for Greek bottled olive oil, as happened in 2019,” Mitrakos noted.

Meanwhile, officials in Greece, including Prime Minister Kyriakos Mitsotakis, have dismissed the American tariffs imposed on European and Greek products as “illogical.”

“Greece insists that we have a unified response so that we can be effective as a group of 27 [E.U. member states],” Mitsotakis said in a cabinet meeting. “In any case, we will fight to defend our national interests.”

Tariffs are essentially taxes on imports of products, which are usually passed on to end consumers in low-margin industries as a percentage of a product’s value.

The 20 percent tariff imposed on olive oil from European producers means that a bottle of extra virgin olive oil sold for $20 in American supermarkets would have a $4 tax on top, bringing the cost to $24.

The Greek table olive sector is also in turmoil after President Trump announced the tariff scheme on E.U. products on April 2nd.

Table olives are the flagship product among all Greek agricultural exports to the United States. In value terms, they account for 27.4 percent of all Greek food and beverage exports to the U.S.

According to Doepel, the Greek interprofessional association of table olives, the 20 percent tariffs slapped on European products imported to the U.S. could favor table olives producers based in countries that are burdened with lower tariffs.

“The increase in the price of the product due to the tariffs and the comparative advantage of other olive-producing countries, such as Egypt, Turkey, Morocco and Latin America that are subject to ten percent tariffs will affect the competitiveness of Greek table olives in the U.S. and, by extension, of our industry,” the interprofessional wrote in a letter to Olive OIl Times.

“The need for diplomatic intervention and support is imperative for the protection of Greek exports and the sustainability of the sector,” the association added.

Greece is also the second-largest supplier of table olives to the United States after Spain. In 2024, table olive exports from Greece to the U.S. reached €214 million, a 39 percent increase compared to 2023.

“The American market is the largest for Greek olives, absorbing 30 percent of the country’s table olive exports,” said Kostas Zoukas, head of the Greek Association of Manufacturers, Packers and Exporters of Table Olives (PEMETE). “Losing the U.S. market would be irreplaceable for the industry.”

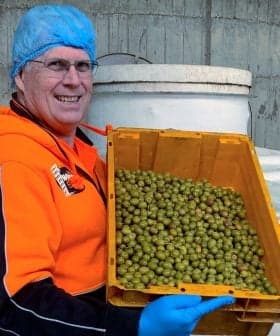

Located near the city of Volos in central Greece, Siouras has exported Greek Kalamon and Chalkidiki olives to various countries, including the United States, since the 1930s.

Owner Haris Siouras said that the Greek olive sector is in limbo after the tariffs were announced on the other side of the Atlantic.

“A ten-percent tariff on our olives is not negligible, let alone a 20-percent added tax,” Siouras said. “For the time being, however, most of our orders from the U.S. are being processed as per normal.”

“The Kalamon olives we ship to the United States are not produced there, so thrusting any tariffs on them has no real meaning,” he added.

Siouras also said that table olives have not yet become an essential food for Americans, and the shrinking budget of American households is a significant factor to consider.

“Despite the fact that Americans are now more keen on adopting a healthier diet, they are likely to reduce how much they spend on table olives if they cost more,” he said.

“In any case, as soon as the tariffs were announced, our sector started to look into ways for Greek olives to be exempted from the Trump tariffs,” Siouras concluded. “But we will have to wait until July when the 90-day tariff pause expires for any definitive results.”