Olive Oil Producers in Turkey Decry Export Freeze

Turkey’s olive oil export ban, implemented to lower domestic prices, is causing concern among local producers and European consumers, who are now seeking alternative suppliers such as Albania, Chile, and Tunisia. The ban, which only affects bulk exports, has led to questions about the reliability of Turkish olive oil exports and is resulting in significant losses for producers who are facing higher production costs and decreased revenue.

Local producers and European consumers feel the impacts two months into Turkey’s olive oil export ban.

In August, Turkey’s Ministry of Trade temporarily restricted bulk exports until November 1st to lower high domestic olive oil prices due to a feared global shortage.

The prohibition only applies to sales of olive oil in packages of more than 16 kilograms and does not include higher-value individually packaged olive oil exports. However, the ban has led to pushback from local producers.

See Also:Signs Suggest a Weak Harvest in Turkey“It was an easy solution to ban exports temporarily, but was it the best solution?” asked Yusuf Urgan, an economist and business consultant at Egina Olive Oil.

“They [the exporters] had long-term contracts and received some penalties,” he told Olive Oil Times.

Urgan added that the ban, the third of its kind in as many years, was calling the reliability of Turkish olive oil exports into question.

“Turkish exporters have signed yearly or quarterly contracts with importers,” an export specialist at a Turkish olive oil producer told Olive Oil Times. “With the ban, Turkey loses reliability, and may prompt importers to avoid imports from Turkey.”

Already, the ban is costing Turkish producers their export markets. As olive oil prices increase, European buyers seek urgent alternative suppliers, including Albania, Chile and Tunisia.

“Turkey’s biggest importer is Spain, which buys olive oil in bulk from Turkey and then bottles the product in Spain before selling it under Spanish brands to the rest of the world,” the specialist said. “Italy does the same.”

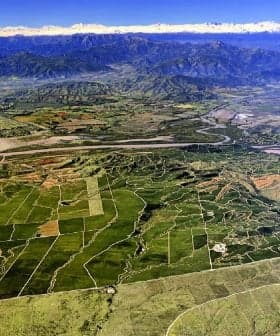

An estimated 50 percent of Turkish exports are in bulk. According to International Olive Council data, Turkey was expected to export a record-high 134,000 tons of olive oil in the 2022/23 crop year following an unprecedented yield of more than 420,000 tons.

Although the ban may effectively ensure domestic prices go down, “it represents some serious losses for producers,” the specialist said.

“For example, before the ban was imposed, domestic prices were 185 Turkish lira (€6.31) per kilogram,” the specialist added. “After the ban, prices decreased to 170 Turkish lira (€5.80) in just one week. Turkish exporters have worked hard to earn their place in the world market, and the ban makes doing business harder.”

Urgan noted that Turkish olive oil producers faced multiple challenges before the ban, including higher costs for agricultural inputs, diesel and labor, resulting in higher overall production costs. The ban means many producers face these higher costs after earning less revenue.

Outside of Turkey, industry analysts said the export ban has contributed to persistently high olive oil prices across Europe.

“There are concerns that the E.U.’s olive oil production may plunge compared to the five-year average,” Kyle Holland, an analyst at Mintec, told local media. “The market may contract, which could lead to an increase in olive oil prices in the short-term.”