Beef and Olive Oil Deal Breakers in Ongoing EU-Mercosur Talks

Sensitive agricultural products are the sticking points in the almost two-decade-long negotiations of the EU-Mercosur Association Agreement.

The ongoing negotiations between the EU and Mercosur aim to eliminate high tariffs and customs duties in various sectors, with EU farmers expressing concerns about potential concessions in agricultural products like beef, poultry, sugar, and orange juice. The EU-Mercosur trade deal has been a point of contention for almost two decades, with hopes for a consensus to be reached by the end of 2017, and negotiations continuing into 2018.

Negotiations between the European Union (EU) and the South American trade bloc Mercosur are ongoing as each region aims to protect its agricultural sector.

The EU has given far too much on agriculture to the Mercosur countries in the negotiations, without getting much in return.

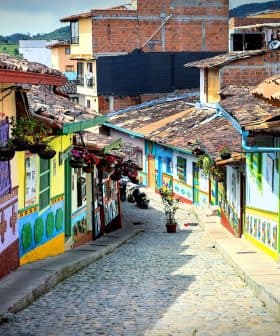

The aim of the EU-Mercosur Association Agreement is to eliminate high tariffs and customs duties in several sectors. With such an agreement in place, EU companies would have better access to Mercosur’s market of 260 million consumers. At the same time, the Mercosur countries (made up of Argentina, Brazil, Paraguay and Uruguay) would benefit from preferential access to the 28-country-strong EU market.

European farmers have asked the European Commission to “reject any concessions” in several agricultural sectors like beef, poultry, sugar and orange juice, citing concerns about unfair competition and a potential reduction in growth and jobs. In a press release dated January 24, Copa-Cogeca, an organization that represents 66 farmers’ organizations from across the European Union asked the EU to not make any concessions during the trade talks.

Speaking at a press conference in Brussels on January 24, its Secretary-General Pekka Pesonen took a stand on behalf of the EU’s 22 million farmers: “The EU has given far too much on agriculture to the Mercosur countries in the negotiations, without getting much in return,” he declared. “A Joint Research Centre (JRC) report shows a potential trade deal could cost the EU agricultural sector over 7 billion euros… Farmers and their cooperatives should not have to pay the price of a potential trade deal with Mercosur countries in return for concessions in other sectors.”

The organization also outlined its concerns in a letter sent to the EU Council, Members of European Parliament, the European Commissioners for Trade and Agriculture and Rural Development and the Vice President of the European Commission.

Beef is one of the most contentious agricultural products being discussed during the negotiations. The EU currently imports 75 percent of its beef, or 250,000 tonnes per year, from the Mercosur countries tariff-free. The South American trade bloc is asking for the EU to take a further 70,000 tonnes but EU beef farmers fear the potential negative effects of oversupply on the EU market.

At the same time, Mercosur is a major market for EU agricultural products like olive oil, frozen potatoes, malt, pasta, chocolate, fruit, wines and spirits. EU exporters of these high-value products could benefit from the reduction or removal of tariffs.

But in Argentina, the Argentinian Olive Oil Federation is asking for olive oil to be excluded from negotiations in fear that reduced entry tariffs would harm the country’s own olive industry and cause a loss of jobs in the sector. For Argentina, olive oil has been one of the sticking points in EU-Mercosur negotiations since 2010.

In fact, negotiations on the details of the EU-Mercosur trade deal have been ongoing for almost two decades and, after an impasse, were restarted in 2010. There were hopes that consensus would be reached by the end of 2017 but talks will continue on January 29 and 30 at a meeting of EU agriculture ministers. Once a deal is eventually worked out, the EU will be the first trade partner to conclude a trade agreement with the Mercosur bloc.