Portugal Enjoys Record-High ‘Off-Year’ Harvest

The country is expected to produce slightly more than 126,000 tons, the fourth-highest yield on record. Initial estimates forecasted production of fewer than 100,000 tons.

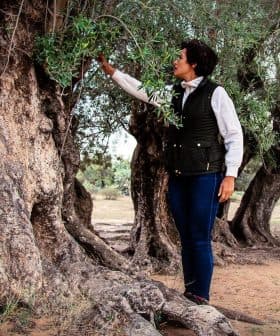

Photo: Viveiros Monterosa

Photo: Viveiros Monterosa The Portuguese government has exempted olive oil from value-added tax to help ease inflation’s impact on grocery bills. Despite a decline in olive oil consumption, production in Portugal is expected to continue growing, with a focus on quality and international recognition for Portuguese olive oils. The industry is working on differentiation and promotion strategies to compete with major producers like Spain and Italy.

Olive oil prices in Portugal are poised to cool down after the government included olive oil on a list of products exempt from value-added tax.

The goal of the new measure is to soften the impact of inflation on families’ grocery bills.

Olive oil production in Portugal will continue to grow, with the possibility of becoming the third-largest European producer.

Expected olive oil consumption for the 2022/23 crop year in Portugal is estimated to reach 61,000 tons by the International Olive Council, slightly below the five-year average.

“Olive oil consumption has fallen in recent years, which is not exclusive to Portugal, with other European producing countries registering the same phenomenon,” Gonçalo Moreira, manager of an olive oil sustainability program in the southern Alentejo region, told Olive Oil Times.

See Also:2022 Harvest Updates“We are witnessing changes in eating and consumption habits, with less cooking and more processed foods and less literacy in food acquisition and preparation, such as cooking food or traditional dishes,” he added. “The younger generations are also more willing to adhere to alternative diets that generally promote other fats.”

Despite stagnant consumption, olive oil production in Portugal continues on its upward trajectory, with producers anticipating a record-high yield for an ‘off-year’ with many producers entering the low phase of the natural alternate-bearing cycle of the olive tree.

The long-lasting drought and weather extremes that affected much of the West Mediterranean basin during the past year have also affected production figures. Last August, Portuguese olive oil producers estimated the yield would fall below 100,000 tons.

However, data from the National Institute of Statistics (INE) indicate that production in 2022/23 will be far higher. The INE said 126,000 tons had already been produced in the country by the end of December.

This figure would make the current crop year the fourth-largest in the country’s history, which in recent years reported growing yields. Last year, Portugal enjoyed a record-breaking harvest, which the INE said exceeded 230,000 tons. According to the IOC, Portugal produced 206,200 tons last year.

Moreira said it is still too early to tell what the yield may be like in 2023/24, and predictions could not be made until the olive flowering later in the spring. Still, he said investments in modern olive growing in Portugal would likely result in increased production.

“Olive oil production in Portugal will continue to grow, with the possibility of becoming the third-largest European producer,” Moreira said.

“This will be helped by the new olive groves that are being installed and the conversion of olive groves in canopies to other more productive methods, such as olive groves in hedgerows,” he added.

Alentejo is the country’s most relevant olive oil-producing region, but investments in modern olive growing are also expanding in other areas.

“On top of this, we have an increase in the number of new 4.0 mills, built and equipped with the most modern technology, which allows for optimized olive oil extraction and yields the highest quality,” Moreira said.

According to INE, olive oil quality in 2022/23 is high, with good organoleptic characteristics and low acidity.

“Each year, more companies are producing high-quality olive oil in Portugal,” Alberto Serralha, owner of the award-winning producer Sociedade Agrícola Ouro Vegetal, told Olive Oil Times.

He added that the high quality of Portuguese olive oil is seldom recognized as it should be. “Portugal needs a professional entity to promote our olive oils on the international markets in the same way as Spain, Greece and Italy do,” Serralha said.

“Today, the path is unclear for quality producers trying to grow and differentiate in export markets due to scale and limited marketing budget,” he added. “Additionally, the competition from other countries is quite serious; nowadays, any producing region has exceptional producers.”

“The logical path for high-quality Portuguese producers is to seek differentiation that traditional varieties provide as somewhere there is a market that appreciates their uniqueness,” Serralha continued.

Another award-winning producer, Antonio Duarte, owner of Viveiros Monterosa, confirmed that much more could be done to improve international recognition for Portuguese olive oils.

“There is still a lot to do for the brand ‘Made-in-Portugal’ compared to major olive oil producers such as Spain or Italy,” he told Olive Oil Times. “In recent years, a policy promoting Portuguese olive oil has been developed, but we still have a long way to go.”

“The general feeling is that Portuguese olive oil is of excellent quality, but it is not very easy to find,” Duarte added. “Most high-quality olive oil producers are small or medium-sized.”

Still, he acknowledged that the situation is slowly improving. “Portuguese olive oils have been more valued in recent years mainly because they have been awarded regularly in various international competitions,” Duarte said.

“All the work that producers have done and their recognition with the awards has facilitated the acceptance of our olive oils, and little by little, we see the Portuguese olive oils being marketed in various countries,” he said.

As the new season rapidly approaches, Moreira said: “2023 started cold and with little rain. At the end of February, the south was already in a mild to moderate drought, with the center and north in a normal situation of humidity and rain for the season.”

“Despite the humidity in March, the high temperatures do not allow water to build up in the soil,” he added.

Still, the river basin levels are reassuring, sitting at least 85 percent capacity in the south. However, water scarcity is always on growers’ minds.

“Olive growers know the impact that the lack of water can bring and have made their olive groves more resilient,” Moreira concluded.

Share this article