Pandemic Delays Argentina's Exports

Dropping demand for table olives and olive oil in Brazil combined with low prices for both mean many producers are having problems remaining solvent. Some are getting emergency loans while others cut costs.

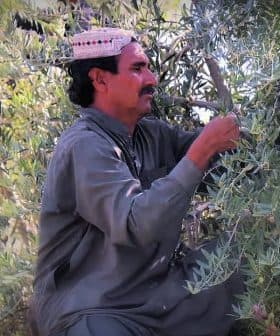

Pablo Radice for Olive Oil Times

Pablo Radice for Olive Oil TimesThe Covid-19 pandemic has severely impacted table olive and olive oil producers in northwestern Argentina, with exports to Brazil coming to a halt due to slowing demand and low prices, leaving many producers struggling to pay their harvesters and considering abandoning their groves. The devaluation of Brazil’s currency has made it more expensive for importers to buy Argentine goods, leading to projections of a significant decrease in imports from Argentina in 2020 and causing many producers to seek emergency loans to cover their production costs.

The Covid-19 pandemic has dampened the economic prospects of table olive and olive oil producers in northwestern Argentina, as exports to the lucrative Brazilian market grind to a halt.

Slowing demand in Brazil combined with low olive oil prices, have left many producers barely able to pay the wages of their harvesters. Some are even considering whether or not to abandon their groves.

Companies seeking to continue their activity will have to review their expenses and cost schedules. They will either make adjustments, and so are one step away from abandoning their farms and lowering production.

“The issue of coronavirus has slowed sales,” Julián Clusellas, president of the Valle de La Puerta olive oil company and a board member of the Argentine Olive Federation, told Olive Oil Times. “Transportation is slower and the costs are a little more expensive. But the main problem is that consumption is going to slow down.”

Brazil is by far the largest market for Argentine table olives and a significant one for the country’s olive oil as well.

See Also:Covid-19 UpdatesBetween 65 and 70 percent of Argentina’s table olive harvest is exported to Brazil, Clusellas said. On the other hand, about 17 percent of Argentina’s olive oil exports from 2017 – the last year for which data are available – were destined for Brazil, according to the International Trade Center.

“We know that there are several oil producers who are having difficulty exporting for lack of firm demand and are at high risk from the situation that we see with the Brazilian market today,” Clusellas said.

The coronavirus pandemic has hit Brazil particularly hard. To date, the country has more than 101,000 recorded cases and an official death toll of more than 7,000. However, testing has been limited and many experts believe both figures are far higher.

While much of Brazil has not closed down due to the pandemic, the country’s economy has contracted significantly. The real, Brazil’s currency, has devalued by 45 percent, making it far more expensive for importers to buy Argentine goods.

“Brazil is not a country that has a flexible exchange rate, so when the currency devalues, merchants do not update prices and imports fall,” Clusellas said.

The country’s retailers are less likely to restock their shelves when the real devalues because their profit margins on imported table olives and olive oil drop significantly.

According to projections from the Getulio Vargas Foundation, a Brazilian think tank focused on the economy, imports from Argentina in 2020 are projected to decrease by 11.7 percent compared to last year. In practical terms, that comes out to $9.32 billion in lost revenue for Argentine producers across a variety of sectors.

However, Clusellas added that olive oil producers who export to Europe and the United States have only had minor inconveniences caused by the pandemic. According to the International Trade Center, Europe and the U.S. were the destination of 57 percent of the country’s olive oil exports in 2019.

On top of slowing demand in Brazil, prices for both table olives and olive oil have remained persistently low for more than a year.

Clusellas said that many producers in Argentina are selling for less than half the value they were in the 2017/18 crop year, with many of them unable to cover their production costs. In order to remain solvent, some have had to turn to the country’s national bank in order to receive emergency loans.

Clusellas warned that this could be the beginning of a vicious cycle; one in which producers have to cut costs in order to remain in business. This, in turn, will impact their ability to return to pre-pandemic production levels and grow exports after the coronavirus crisis has passed.

“Companies seeking to continue their activity will have to review their expenses and cost schedules,” Clusellas said. “They will either make adjustments, and so are one step away from abandoning their farms and lowering production. Maybe some will even convert to raising livestock.”