Olive Oil Producers in Argentina Beat the Heat, Enjoy Fruitful Harvest

After three below-average harvests, producers in Argentina expect a return to the norm. However, inflation continues to create problems for domestic sales and exports.

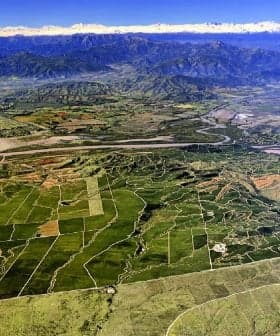

(Photo: Solfrut)

(Photo: Solfrut) Olive farmers and oil producers in Argentina had a successful harvest this year after several disappointing seasons, with expectations of a higher yield than the previous crop year. However, challenges remain due to ongoing economic issues, high inflation, and the impact of hot summers on olive production, leading some producers to consider changes in cultivation methods to improve efficiency and reduce costs.

Despite a scorching summer, olive farmers and oil producers across most of Argentina enjoyed a successful harvest this year after three disappointing seasons from 2020 through 2022.

While the final figures from the harvest will not be known until early September, several of the country’s largest producers told Olive Oil Times they expected this year’s yield to be far higher than the 2021/22 crop year.

The high inflation figure has a completely negative impact on the entire olive supply chain… Prices always vary upwards, so you have to be very careful both when buying and selling, be it raw materials, inputs, services.

According to provisional data from the International Olive Council, Argentina produced 33,000 tons of olive oil in 2021/22, although some believe the figure will have to be revised downward.

“In the northern provinces, including Catamarca, La Rioja and the north of San Juan, there was an average yield; but with an important increase compared to 2022,” Sergio Castello, the country representative of Pieralisi in Argentina and producer behind Almaoliva, told Olive Oil Times.

See Also:2023 Harvest Updates“In the middle of Argentina – the south of San Juan and Mendoza – the harvest was good, a little above average,” he added. “The problem in the east Mendoza was the frost and hail. And in the south region, that is, San Rafael (in the south of Mendoza) and Neuquén, they had a really good harvest; much more quantity and above average.”

In Chilecito, a department in the province of La Rioja home to many olive groves, producers confirmed initial predictions of a bountiful harvest.

“We had a much higher campaign than 2022,” Guillermo Kemp, the commercial director of Solfrut, told Olive Oil Times. “This year, we have milled more than 22,000,000 kilograms of olives in our new industrial plant.”

According to local officials, Kemp added that he expects the company to produce about 3,500 tons of olive oil this year, which may well exceed the total from the province of Mendoza.

“An estimate, since olives are still being harvested, would be around 2,200 to 2,500 tons of olive oil,” Mario Bustos Carra, the general manager of the Chamber of Foreign Commerce of Cuyo, told Olive Oil Times. “Compared to previous years, it is lower by more than 50 percent.”

Argentina’s bumper harvest comes immediately after the confirmation of poor harvests across the Mediterranean basin, with anticipation of production declines in Spain, Turkey, Portugal and Greece also expected in the 2023/24 crop year.

As a result, some producers in Argentina have the chance to expand exports and bring in much-needed U.S. dollars. However, the complicated situation surrounding Argentina’s parallel currencies means the benefits are not as great as they seem.

“[Rising olive oil prices due to the poor harvest in Europe] is a good and bad thing,” Castello said. “It is good because olive oil is like a commodity, so the global price rises, and you get more dollars for every ton. However, if the price goes much higher, it is dangerous because the final price of the bottle becomes too expensive, and people stop buying.”

Bustos Carra said producers in Mendoza would likely miss this opportunity due to the poor harvest.

The harvest results are especially disappointing since this would have been the first year adhering producers could bottle their extra virgin olive oil using the Mendoza PGI (Protected Geographical Indication) certification from the European Union.

“Prices rise precisely because of the bad European harvests, but there is not enough production in our province to take advantage of the moment; besides that, the exchange rate delay and inflation do not contribute to generating great expectations,” Bustos Carra said.

Kemp, from Solfrut, added that Argentine producers who focused on quality would benefit as the world’s largest olive oil sellers in Spain and the United States look south to replenish dwindling olive oil stocks.

Kemp added that his company’s biggest challenge is revitalizing the domestic market. “With regard to sales, the main challenge is to normalize prices for the domestic market,” he said.

Normalizing prices in Argentina is a challenge that feels unattainable to many. Annual inflation in the country remains staggeringly high, at 115 percent in June. Furthermore, ongoing negotiations between the government and International Monetary Fund to release funds and replenish the country’s depleted foreign currency reserves have resulted in plans to weaken the peso for trade purposes.

“The high inflation figure has a completely negative impact on the entire olive supply chain, not only in our province but also at the national level,” Bustos Carra said. “Prices always vary upwards, so you have to be very careful both when buying and selling, be it raw materials, inputs, services, etc.”

“Additionally, the national government applies a policy that keeps the price of the dollar below the inflationary percentage, which means that the value of the currencies that are charged for our exports is well below their real value in our country,” he added.

Julián Clusellas, president of the Valle de la Puerta and a board member of the Argentine Olive Federation, confirmed Bustos Carra’s assertions. He told Olive Oil Times that a weakening peso for trade purposes would create further headaches for exporters, causing the value of exports to fall compared to the price of inputs, especially fertilizer and labor.

Valle de la Puerta sells olive oil in bulk to large bottlers in North America, Europe, and the domestic market. When he sells his olive oil for dollars or Euros, he brings those hard currencies back to Argentina and must convert them to pesos at the official rate – about 276 pesos per U.S. dollar at the time of writing.

However, he said many of his expenses are priced in the parallel dollar – the blue dollar, colloquially – valued at about 515 pesos at the time of writing.

Along with ongoing macroeconomic uncertainty, Clusellas said increasingly hot summers have also created challenges for some producers. The poor harvest in the 2021/22 crop year was attributed to scorching summer temperatures interfering with oil accumulation.

“In Catamarca, olive trees are being replaced with Hojiblanca for table olives,” he said. “The climate in Catamarca is becoming too hot in the summer, and olives are accumulating very little oil.”

Clusellas added that other growers in northern Argentina are also considering making the switch.

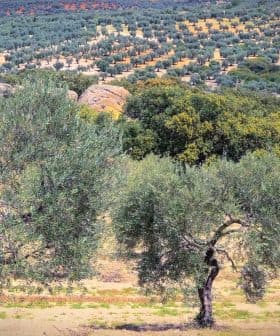

Meanwhile, in La Rioja and San Juan, a gradual shift from high-density plantations to super-high-density plantations is taking place as producers seek to reduce costs and improve quality consistency.

They are currently experimenting with various hybrid olive varieties bred specifically for super-high-density planting. Clusellas said the goal is to make the olive harvest more efficient.

“This will lower the costs of harvesting, increase the speed of the harvest and improve the economics of olive growing in Argentina,” he concluded.

Share this article