Bi-Oceanic Corridor Would Boost Argentina's Exports

The Minister for Planning and Industry in La Rioja said that the provincial government had already been in talks with seven other provinces in both Argentina and Chile about making headway on the project.

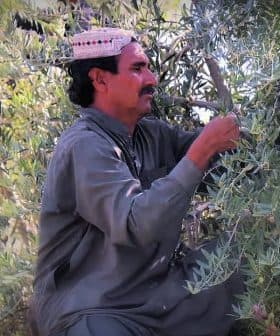

The Minister for Planning and Industry in La Rioja, Ruben Galleguillo, is pushing for the implementation of a bi-oceanic corridor connecting Brazil, La Rioja, and Chile to boost olive oil exports to Asian markets. The project, estimated to cost $1.5 billion and take 8.5 years to complete, aims to lower costs and increase product value for Argentinian producers, particularly in La Rioja.

A senior government official in the Argentinian state of La Rioja has called on plans for a bi-oceanic corridor to come to fruition as soon as possible.

We are proposing to the national government the need to implement the bi-oceanic corridor, which would connect the Atlantic and Pacific ports.

The corridor will begin in Porto Alegre Brazil, pass through La Rioja and finish in Coquimbo, Chile. Ruben Galleguillo, the Minister for Planning and Industry in La Rioja said that the provincial government had already been in talks with seven other provinces in both Argentina and Chile about making headway on the project.

Both he and olive oil producers from La Rioja believe that the corridor would boost Argentinian olive oil exports to Asian markets by lowering costs and increasing product value.

See Also:Olive Oil Health Benefits

“The bi-oceanic corridor is a very interesting project,” said Frankie Gobbee, CEO and co-founder of the Argentina Olive Group, which is based in La Rioja. “Argentina would have a direct outlet to the Pacific, lowering the cost of exporting to Asian markets by up to 25 percent.”

Gobbee also pointed out that the bi-oceanic corridor would include a 13.9‑kilometer tunnel through the Andes, further expediting the shipping of olive oil to the Pacific. This would help keep the oil fresh, which Gobbee believes would benefit Argentinian producers.

“What Argentina produces during the year, it also sells that same year,” said Gobbee. “That gives greater security to international buyers because they always receive fresh oil from the current harvest.”

La Rioja is the leading producer and exporter of olives and olive oil in Argentina. Last year, 70 percent of Argentinian olive oil exports came from La Rioja. Many in the province believe that the emerging Asian markets are where the future of olive oil exports lie.

© Olive Oil Times | Data source: International Olive Council

Australia, China, Japan and South Korea are among the top 25 olive oil importers in the world and, in the past five years, have seen considerable growth in consumer demand for olive oil. The four nations combined to import almost 145,000 tons of olive oil last year.

Argentina is already one of the seven largest exporters of olive oil to China, according to Daxue Consulting, a Chinese-based market research firm.

According to the Inter-American Development Bank, which is financing the project, the corridor will take nearly 8.5 years to complete and cost $1.5 billion.

“We are proposing to the national government the need to implement the bi-oceanic corridor, which would connect the Atlantic and Pacific ports,” Galleguillo said. “We have been working with seven provinces on the need to link up with the third region of Atacama, in Chile. There they have deep water ports to go mainly to the Asian markets.”

He addressed members of the agricultural sector at a food and drink exposition recently, highlighting La Rioja’s importance to Argentina’s growing olive oil industry.

Marcelo Capello, president of Argentina’s Mediterranean Foundation was another speaker at the event. He emphasized the economic importance of connecting La Rioja and the Northwest of Argentina to Chilean ports.

“The Northwest of Argentina is far from the ports of Buenos Aires and Rosario, but is key to the country’s growing export industry, much of which can be sold to emerging Asian markets,” said Capello. “For this the infrastructure must be improved and in this sense the project must be looked at as a joint effort.”