Transporters Warn of Effects of Covid-19 Measures on Food Supply

Apr. 2, 2020 09:57 UTC

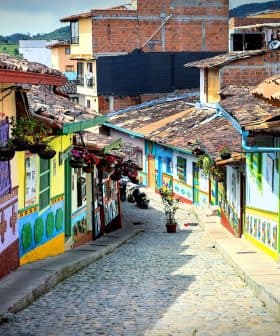

Apr. 2, 2020 09:57 UTCCovid-19 containment measures and uncertainties among transporters are slowing down international trade and food supplies in Italy, causing concerns for olive oil bottlers trying to meet demand. European logistics workers fear being caught in changing policies while on the road, prompting the Italian government to address bureaucratic hurdles hindering the free flow of goods.

The Covid-19 containment measures coupled with uncertainties among the transporters have been slowing down international trade and food supplies in Italy.

The company I work for based in Romania warned me and my colleagues that some operations could be halted at any time.

Olive oil bottlers are struggling to ensure that imports will be reaching their factories in the coming weeks to meet the demand.

Many European logistics workers expressed fears that coming to Italy could put them in quarantine upon returning to their own countries. New safety measures and additional documentation requests have been taking their toll on olive oil and other crucial food imports.

See Also:Covid-19 CoverageThe Italian federation of the food and beverage industry, Federalimentare, warned that things must change quickly.

“We were among the first ones to point out that question about the foreign transporters, many of whom did not want to come to Italy,” said the federation’s president, Ivano Vacondio. “The situation has now started to change since we are not the only ones in Europe to suffer the effects of the Covid-19 epidemic anymore.”

Part of the problem lies with the fact every European country has independently decided its own containment measures and its own approach to Covid-19.

Some workers fear they could be caught in the middle of changing policies while on the road away from their countries.

“The company I work for based in Romania warned me and my colleagues that some operations could be halted at any time,” Nico Balan, a Romanian transporter living in central Italy explained to Olive Oil Times. “Some of my colleagues based in Romania still fear quarantine actions once they go back.”

Uneasiness has spread among food supply-related workers. That is why the European Commission, Vacondio said, has now threatened penalties for any interference with the free circulation of goods within the E.U. as it is defined and regulated by the current treaties.

Just hours ago, the United Nations and the World Trade Organization warned of possible slowdowns in international food supply lines because of containment measures and panic buying. “Uncertainty about food availability can spark a wave of export restrictions, creating a shortage on the global market,” the heads of the global agencies wrote.

The major Italian transport and logistics associations have written to the Italian government to demand quick action on several bureaucratic hurdles that they believe hinder the free flow of goods.

Those problems stem from the suspensions of services that occurred with the Covid-19 lockdown including difficulties in updating transport documents or drivers’ permits, as well as the availability of rest and service areas on the highways since many have closed down.

Federalimentare estimates a 20- to 30 percent loss of revenue for the industry in the first month of quarantine.

“Thanks to the strong growth of domestic expenditures on food we could limit damages deriving from the bar and restaurant shutdowns, but we cannot become inattentive on the import side. Even the most organized supply chains have raw materials stocked in their warehouses that will not last more than a couple of weeks,” Vacondio said.

Italy is heavily dependent on olive oil imports both to meet the domestic demand and to provide Italian marketers enough product for their international operations.

The latest data from the Ministry of Agriculture puts Italian olive oil stocks at 264,000 tons, with just above 170,000 tons of Italian origin. With the spike in sales recorded in Italy and other European countries since the beginning of the Covid-19 emergency, requests for olive oil products are now set to grow.

Paolo DeAndreis

Paolo DeAndreis