U.S. and Spanish Officials Discuss Future of Tariffs, Trade

United States and Spain officials discussed strengthening their trading relationship, including resolving disputes over tariffs on olive oils and table olives. The recent suspension of tariffs between the U.S. and E.U. over aircraft subsidies has provided a temporary reprieve for Spanish olive exporters, but long-term solutions are still needed for the digital tax and other trade issues.

Officials from the United States and Spain spoke for the first time this week to discuss the future trading relationship between the two countries.

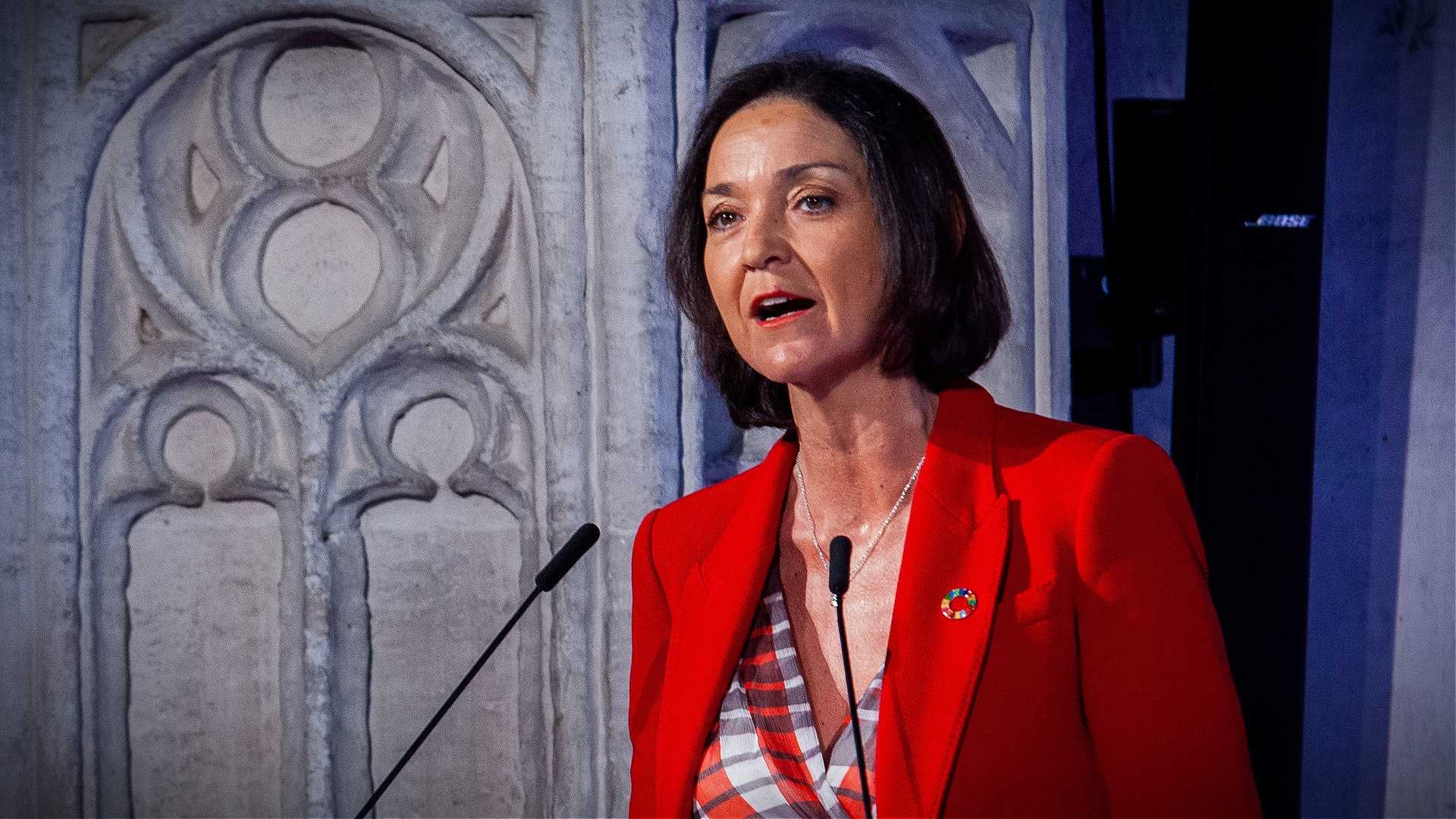

Recently-confirmed U.S. Trade Representative Katherine Tai met with Reyes Maroto, the minister of industry, trade and tourism, to discuss developing a “more positive and productive” trading relationship between the two sides.

The escalation in the commercial conflict is something that has not benefited either party.

“They agreed to work to strengthen U.S.-Spanish collaboration on mutual interests, including resolving the Word Trade Organization large civil aircraft disputes,” the office of the U.S. Trade Representative said in a statement. “They also discussed Spain’s digital service tax… and the two countries’ shared commitment to finding mutually beneficial outcomes.”

Earlier this month, the European Union and the United States agreed to suspend temporarily the combined $11.5 billion (€9.65 billion) worth of tariffs each side had imposed on the other over illegal subsidies provided to aircraft manufacturers Boeing and Airbus.

See Also:Trade NewsSpanish virgin and non-virgin packaged olive oils and some types of Spanish and French green table olives were hit with a 25-percent tariff as part of the package of punitive measures levied by the U.S.

During the 16 months in which U.S. tariffs were in place, Spain’s bottled olive oil and table olive sectors were severely impacted.

According to Spain’s Food Information and Control Agency, bottled olive oil exports to the U.S. decreased by 80 percent in 2020, compared with 2019.

The Spanish Association of Table Olive Exporters and Producers (Asemesa) also reported that the sale of green table olives to the U.S. fell by 25 percent.

“The escalation in the commercial conflict is something that has not benefited either party,” Maroto said. “A new stage opens for the development of a positive collaborative agenda between two powers destined to be allies and close collaborators in the face of current challenges.”

The suspension of the tariffs will last until the beginning of July, when the two sides will need to decide whether to extend the moratorium or reimpose the tariffs.

However, officials from Asemesa warned that the four-month reprieve from tariffs would not significantly affect exporters and urged Spanish and European officials to use this time to come up with a long-term solution to the Boeing-Airbus conflict.

“The current four-month tariff truce agreed between Washington and Brussels will only be noticed in occasional sales, but not in most export operations, which are negotiated with annual contracts,” Asemesa said in a statement. “American buyers will not change providers solely for the announcement of the temporary suspension of tariffs and the opening of a negotiation.”

See Also:Spain, Uruguay Try to Revive Stalled EU-Mercosur Trade AgreementWhile U.S. and E.U. negotiators hope to find a solution to the Boeing-Airbus conflict, digital tax legislation implemented in January by the Spanish government has created new tensions with the U.S.

Last week, Tai announced that she would maintain the threat of imposing additional tariffs on Spain in retaliation for the digital service tax, which requires all companies that earn more than €3 million of income in Spain and at least €750 million globally to pay a three-percent tax.

American technology companies, including Amazon, Facebook and Google, have been hit the hardest by the new law.

“The United States remains committed to reaching an international consensus through the Organization for Economic Cooperation and Development process on international tax issues,” Tai said. “However, until such a consensus is reached, we will maintain our options under the Section 301 process, including, if necessary, the imposition of tariffs.”

Tai and Maroto agreed to further discuss the digital tax and other issues in future meetings. While no date for the next set of talks was given, both sides agreed to “engage on a regular basis to raise and discuss key issues.”

However, one issue that was not brought up by either side during the conversation was the imposition of a 35-percent tariff on exports of black olives from Spain to the U.S.

Asemesa said Spain and the E.U. should use the easing of trade tensions and get the U.S. to retract the anti-subsidy and anti-dumping tariffs that were initially imposed on Spanish producers in 2017.

Combined with the tariffs on green olives, the anti-dumping and anti-subsidy measures have cost the Spanish table olive sector an estimated €135 million in the past 3.5 years.

“Asemesa believes that the E.U. should take advantage of this climate of understanding with the new American president to also find a solution to the problem of the tariff on black olives,” the association said.

The U.S. and Spain are currently awaiting a decision from the World Trade Organization about whether the tariffs have a legal basis and can remain in place. A decision is expected by the end of June.

Officials at Asemesa see this case as a bellwether for other industries and argue that the failure of Spain and U.S. to reach a negotiated settlement could lead to future cases being brought against other European agricultural sectors.

“It is very important to be aware that if the WTO agrees with the United States in this case, as it did in the Airbus case, the E.U. would be forced to return and redistribute all Common Agricultural Policy aid with different criteria,” Asemesa said.