China Wants More Olive Oil and Italy Is the One Providing It, for Now

The Chinese appetite for olive oil has led to an increase in exports from Italy, but competition from Tunisia and the domestic market could see this trend reverse.

Shanghai , China

Shanghai , ChinaItalian olive oil exports to China increased by €40 million in 2017, surpassing Spain as the largest exporter to China due to the growing middle class and increasing interest in olive oil in the country. This increase was also driven by lower tariffs on Italian olive oil and decreased production costs, making it more competitive in the Chinese market.

Italian olive oil exports to China increased by €40 million in 2017, according to the National Institute of Italian Statistics.

Spain has traditionally been the largest exporter to China, but the tides may be changing, according to industry analysts. As incomes in the world’s most populous country grow, so does the appetite for travel and olive oil. This increasing middle class has opened the doors for other oil exporters, such as Italy.

Sales of Italian products to China increased by 18 percent. Among them, olive oil exports have the biggest growth of 41 percent.

“It is a developing market that is experiencing impressive annual growth and will become increasingly central [to the olive oil trade],” said David Granieri, president of Italy’s largest association of olive oil producers, Unaprol.

“This is why it is essential to promote the culture of conscious consumption of high-quality extra virgin olive oil and develop appropriate marketing strategies to enhance the symbolic product of the Mediterranean diet.”

The increase of Chinese tourists visiting Italy has helped introduce many of China’s burgeoning middle class to olive oil. According to Eda Erbeyli of Daxue Consulting, a company that analyzes trends in the Chinese market, 1.4 million Chinese tourists visited Italy last year. The European Union has also had its eye on the Chinese market for some time now and cooperation between the two is on the rise.

“The President of the European Commission Jean-Claude Junker and the Chinese Prime Minister Li Keqiang have decided that 2018 will be the EU-China tourism year, in order to improve tourism and economic cooperation between China and the EU,” she said. “This rise of tourism in Italy helps tourists discover a variety of Italian products, such as olive oil.”

Italian ministers Maurizio Martina and Dario Franceschini have also announced 2018 will be the “year of Italian food in the world” with the intention of promoting Italian culture and food abroad. China is one of the markets on which they are primarily focusing and this is part of what has spurred the more than 40 percent growth of Italian olive oil exports.

Various economic factors have also led to the increase, according to Erbeyli. In 2016, China lowered tariffs on Italian olive oil that were long considered prohibitive for entry to the market. The decreasing cost of importing also coincided with cuts to production costs in Italy. All of the sudden, it made increasing sense for Chinese consumers and Italian exporters to do business together.

“Italy is considered as a ‘most-favored nation’ and its olive oil has a 10 percent tax rate [down from 30 percent prior to 2016].” Erbeyli said. “Then in January 2018, the production costs [for Italian companies] decreased by 2.9 percent compared to the same period one year ago. Lower production costs improved the competitiveness of exporters.”

In spite of increasing production across the EU, olive oil exports from the trading bloc to China are not predicted to increase next year. Italy will be the only EU country that experiences an increase in exports to China.

“Italian food exports to China rose dramatically in 2017: the sales of Italian products to China increased by 18 percent,” Erbeyli said. “Among them, olive oil exports have the biggest growth of 41 percent.”

Spain still dominates the Chinese olive oil market, making up 80 percent of olive oil exports, but is forecasted to see its market share decrease. Drought in the heart of Spain’s olive growing regions has been blamed for recent production dips in the world’s leading olive oil regions.

“Spain still dominates, by far, the olive oil market,” Erbeyli said. “However, Chinese imports of Spanish olive oil remained relatively stable in 2016/17 and may decrease for the 2017/18 crop-year.”

Olive oil imports are expected to continue to grow in China as well. However, competition for Italian oil increasingly will come from outside of the EU.

“Tunisia is planning to export 200,000 tons of olive oil for the current crop year: it is expected that their global exportations will increase from 85,000 to 180,000 tons,” Erbeyli said. “There is a rising interest in the olive oil from Tunisia in China.”

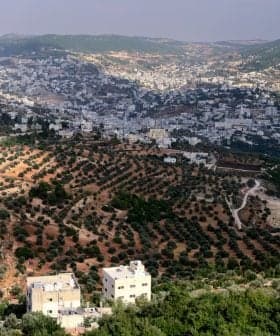

China’s small domestic olive oil market is also growing and local farmers expect they will be able to compete with the traditional olive oil exporters in the next two decades. Olive trees are already being planted in Sichuan province, which is located in south-central China and has a similar climate to that of the Mediterranean basin.

See Also:The Man Behind China’s Unlikely Gold at NYIOOC

Robert Woo is an olive oil taster and marketing executive for the Olive Oil China Exhibition, an annual olive oil contest held in Beijing. He said as the Chinese appetite for olive oil grows so does the desire for a distinctly Chinese product.

“Regarding the growing olive oil demand in China, the trend is going up,” he said. “We think the Chinese olive industry will affect the import of olive oil from the EU in 10 to 15 years because the area of olive planting is still only 175,000 acres and many trees are very young.”