US Threatens Tariffs on EU Olive Oil Imports

A World Trade Organization decision found that the E.U. has unfairly subsidized plane manufacturer Airbus. The result could be retaliatory tariffs on numerous E.U. goods, including olive oil.

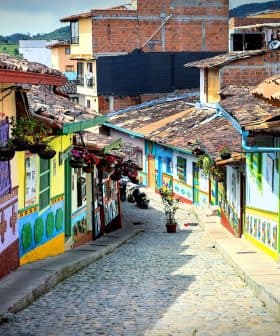

Photo courtesy of Belifl Yarom.

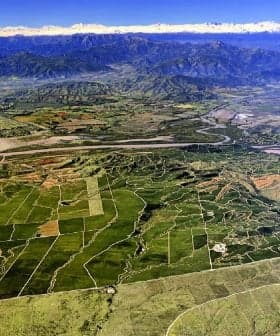

Photo courtesy of Belifl Yarom.The United States has proposed tariffs on $11 billion worth of European Union imports, including olive oil, following a World Trade Organization ruling that E.U. subsidies for Airbus negatively impact American producer Boeing. The E.U. has criticized the U.S. for the exaggerated figure and olive oil producers in Italy, Spain, and Greece are expected to be significantly impacted by the potential tariffs.

The United States has proposed tariffs on $11 billion worth of European Union imports, including olive oil, in light of a decision made earlier this week by the World Trade Organization.

The escalation of tensions between the two comes after a WTO ruling that found E.U. subsidies for Airbus have an adverse impact on American producer, Boeing.

The U.S. threat to impose an import tariff on E.U. olive oil could prove significant for the E.U. industry, as the U.S. imports significant volumes from the bloc.

“This case has been in litigation for 14 years, and the time has come for action,” Robert Lighthizer, the U.S. trade representative, said. “The administration is preparing to respond immediately when the WTO issues its finding on the value of U.S. countermeasures.”

The E.U. has criticized the U.S., saying $11 billion was a greatly exaggerated figure.

See Also:E.U. Challenges U.S. Tariffs on Spanish Olives“The E.U. is confident that the level of countermeasures on which the notice is based is greatly exaggerated,” a source within the bloc told CNBC News. “The amount of WTO authorized retaliation can only be determined by the WTO-appointed arbitrator.”

However, olive oil producers could be among the hardest hit, as more than one-third of olive oil exports are destined the the U.S.

The level of tariffs that the U.S. could impose on E.U. goods is still in arbitration and will not be determined for a few months. However, European olive oil producers could expect tariffs ranging from $0.034 per kilogram to $0.176 per kilogram, depending on the ruling.

“The U.S. threat to impose an import tariff on E.U. olive oil could prove significant for the E.U. industry, as the U.S. imports significant volumes from the bloc,” Gary Howard, a senior news analyst for agribusiness intelligence firm IEG Vu, said.

According to Eurostat, 35 percent of E.U. olive oil exports were destined for American ports during the first fiscal quarter of 2019, with an estimated value of $339 million.

Spain led the way, exporting 35,323 tons. This was followed closely by Italy with 30,898 tons. Portugal and Greece exported 1,410 tons and 3,506 tons, respectively.

During the 2017/18 harvest season, E.U. countries exported 194,570 tons of olive oil to the U.S., with an estimated value of roughly $1 billion.

Italian producers will likely be the hardest hit, according to Ettore Prandini, president of Coldiretti. Nearly half of all Italian olive oil that was exported in the first fiscal quarter of 2019 wound up in the U.S. Last year, Italy exported $436 million worth of the product stateside.

“It is a question of avoiding a clash of unprecedented and worrying scenarios that risks causing a dangerous avalanche effect on the economy, and on relations between allied countries,” Prandini said of the proposed tariffs.

Spanish and Greek producers will also be concerned about them as roughly one-third and one-half of their olive oil exports head to the United States, respectively.

Portugal and other E.U. producers will have less to fear as the bulk of their olive oil is exported elsewhere in the world, most notably Brazil and the Middle East.