Australian Olive Growers Begin Harvest With Mixed Expectations

A light crop year is expected to lead to a limited supply and higher prices.

1484

1484  7.6K reads

7.6K readsAustralian olive growers are experiencing varied crop outcomes, with some beginning to harvest early due to low yields while others plan to start in April. Adverse weather conditions during flowering have impacted production across the country, leading to supply and demand issues and higher prices for olive oil. Despite these challenges, some producers are optimistic about the upcoming harvest, with expectations of good yields in certain regions.

Due to low crop yields, some Australian growers have started harvesting earlier. However, others have reported more favorable outcomes and are planning to begin picking their olives in April.

Michael Southan, the chief executive of the Australian Olive Association, confirmed that the harvest will be slightly down from last year.

Due to a light crop year in Australia, some producers have already started their harvesting machines and commenced processing the initial lots of fruit.

“In some areas, flowering was good, but the fruit set was not so good,” he told Olive Oil Times. “The large groves look like they will have expected yields.”

“The main challenges will be the perennial ones of having the availability of contract harvesters for the smaller groves and contract processors,” he added.

See Also:2024 Harvet UpdatesAmanda Bailey, a committee member of the Australian Olive Oil Association, confirmed that some producers were affected by adverse weather conditions during flowering, fluctuations in temperature and other environmental variables.

She said this had reduced crops across many of Australia’s olive-growing regions. The Australian Olive Oil Association estimated production at 18 to 19 million liters in the previous crop year.

“The challenge of a light crop year in Australia extends beyond the immediate impact on fruit production,” Bailey said. “It also has significant implications for other sectors, notably the bulk industry that drives export supply and food service.”

According to data from the International Olive Council, Australia exported 2,000 tons of olive oil in the 2022/23 crop year, a second-consecutive decline from the country’s record high of 4,000 tons in 2020/21.

“Due to a light crop year in Australia, some producers have already started their harvesting machines and commenced processing the initial lots of fruit,” Bailey said.

She pointed out that the scarcity of fruit yields translates into supply and demand issues, creating a domino effect across markets.

“As a result of the reduced fruit supply, in Australia, there is virtually no bulk olive oil supply available, leading to a further imbalance between supply and demand,” Bailey said. “Consequently, we expect higher prices to persist as producers grapple with the diminished availability of olive oil.”

“The repercussions of the light crop year reverberate, and in response, producers are taking this time to evaluate pruning strategies to enhance tree resilience for future crops,” Bailey added.

She said this year’s reduced crop, coming off a few bumper harvests, represented opposite ends of the spectrum regarding production; both scenarios have significant implications for producers, markets and consumers.

“Bumper crop years result in increased supply, lower prices and economic stimulation, whereas light crop years lead to reduced yields, higher prices and financial challenges for producers,” Bailey said. “It will be interesting to see how it all unfolds. Producers need to ensure that their oil can be stretched as far as possible throughout supply chains to gain maximum return.”

Richard Seymour, the general manager of Mount Zero Olives, a company that sources olives across Victoria and South Australia, told Olive Oil Times that he was expecting to begin receiving green Cerignola table olives for fermentation in mid-March and to launch an early harvest Picual extra virgin olive oil in April.

“Talking to our key growers, we expect this harvest to be okay but down on last season,” Seymour said. “This is largely due to frost in some growing areas just before flowering.”

“The challenge is all to do with the ongoing supply and pricing challenge currently facing the global industry,” he added. “A key focus of our business is the supply into the foodservice sector, and I am not sure how the sector will take another 25 percent price rise.”

Meanwhile, Australia’s largest producer, Cobram Estate, plans to start harvesting in mid-April if the weather conditions are as expected.

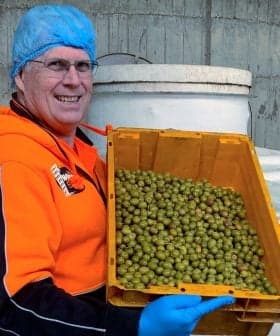

While Cobram Estate expects a good harvest, other producers are less optimistic after being impacted by erratic weather. (Photo: Cobram Estate)

“The 2024 crop season is shaping up well, with initial estimates in line with expectations,” Leandro Ravetti, the company’s co-chief executive and master miller, said. “It is important to remember that this is a lower-yielding crop year on many of our Australian groves and that final yields are subject to the normal risks associated with agricultural production.”

“Flowering for the 2024 crop commenced in mid-October on Cobram’s Australian groves, with full bloom at our Boundary Bend grove occurring during the last week of October and during the first week of November at our Boort grove,” he added. “This was just a few days earlier than the long-term average.”

Ravetti said the company also anticipates lower flowering in some parts of its Boort olive groves than they initially expected, offset by larger-than-expected crops elsewhere.

He attributed the latter to the wetter-than-average start of the crop year (from October to September) and other favorable conditions experienced in Australia during the flowering period.

Also in Victoria, Cape Schanck Olive Estate from the country’s Mornington Peninsula expects a good harvest this year.

“It looks like the trees are quite heavily laden with fruit,” co-owner Stephen Tham said. “With about three months to go before we harvest, they are developing nicely. Disease pressure on the trees, predominantly sooty mold, does not appear to be a concern so far. We anticipate that the harvest will likely surpass the previous year.”

Tham said that despite the Bureau of Meteorology predicting a dry, hot summer due to El Niño after three years of wet weather, they are in the middle of summer, which has not come to pass.

“Late spring and early summer have seen us drenched by rain regularly, particularly in the eastern and north-eastern states and to a lesser extent down south in Victoria,” Tham said. “Our Christmas saw the heaviest rainfall. Temperatures have not been too hot since. Fortunately, the drenching occurred after the fruit set, and we did not lose too much.”

Share this article