Brexit Leads to Sharp Decline in UK Imports of Italian Foods

Italian olive oil stocks in the United Kingdom are shrinking, with imports of extra virgin olive oil, pasta, tomato sauce, cheeses, and wines all decreasing due to Brexit-related bureaucratic hurdles. Coldiretti warned that this trend could lead to an increase in counterfeit Italian food products in the U.K., potentially impacting British consumers who rely on imports for 30 percent of their food, particularly fresh vegetables and fruits from Europe.

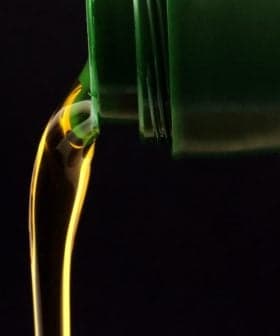

Italian olive oil stocks in the United Kingdom are shrinking.

In the first five months of 2021, Italian extra virgin olive oil imports fell by 13 percent. Shipments of other core ingredients of the Mediterranean diet have fallen too. Imports of pasta dropped by 28 percent, and tomato sauce shipments fell 16 percent.

The United Kingdom could become the Trojan horse for Made-in-Italy fake food, a market valued at €100 billion per year.

Italian cheeses and wines are also decreasing their market shares in the U.K.

The Italian farmers’ association, Coldiretti, placed the blame for all of this squarely on Brexit. They warned that lengthy administrative procedures, oversized border controls and excessive bureaucracy are putting shipping operations worth up to €3.4 billion per year at risk.

See Also:Olive Oil Trade NewsColdiretti data regarding Italian olive oil exports to the U.K. match those reported in Spain. In the first months of 2021, Spanish olive oil exports to the U.K. fell by 35 percent, with Spanish officials also citing increased bureaucratic hurdles as one of the reasons for the slowdown.

Should this negative trend continue, Italian exporters will be significantly impacted since the U.K. is their fourth market, in terms of volume, behind Germany, France and the United States.

According to a recent study cited by Federvini, the Italian wine producers’ association, 95 percent of British consumers buy Italian products in the supermarkets in the post-Brexit era.

A further 66 percent of the British shoppers like to buy Italian food products and consider them among the top three in the world, in terms of quality. This goes up to 70 percent when shoppers under 55 years of age are considered.

Given the current hurdles for Italian imports, Coldiretti noted that the traditional love for the Italian products in the U.K. might boost the prosperous market of counterfeit goods that are packaged to look like Italian-made ones or marketed with names that resemble those of true Italian food specialties.

Coldiretti said that this was a real risk since cases of counterfeit products with a Protected Designation of Origin or Protected Geographical Indication, ranging from Prosecco wine to Parmigiano Reggiano cheese, have previously been identified in the U.K.

“The United Kingdom could become the Trojan horse for Made-in-Italy fake food, a market valued at €100 billion per year whose main operators are in the United States, which may become a privileged commercial partner for the U.K.,” Coldiretti added.

“The British need to watch out for Italian-branded olive oil and parmesan with an Italian flag on the label, which actually comes from America,” Coldiretti’s Lorenzo Bazzana told The Times of London. “Before Brexit, we could ask the U.K. to crack down on fake Italian foods, but now that it is out of the E.U., we cannot. Hence our fear that things could turn for the worse there.”

“We have already seen it happen in Russia, where the moment sanctions stopped Italian food arriving, Russian parmesan, complete with the Italian flag, appeared in stores,” he added.

The reduction of food import volumes is significant for British consumers too. According to the British Retail Consortium, 30 percent of all food eaten in the U.K. comes from abroad. The largest portion of those imports is fresh vegetables and fruits, most of which come from Europe.