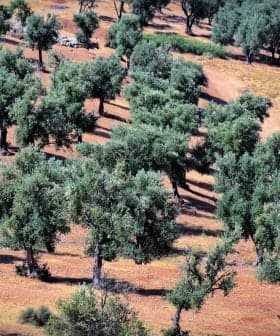

Turkey Braces for Sharp Drop in Olive Oil Output as Weather and Costs Take Toll

Turkey is facing a significant decrease in olive oil production due to the natural biennial cycle of olive trees and harsh weather conditions during flowering. Estimates suggest that the country will produce 310,000 tons of olive oil in the 2025/2026 season, with concerns about rising costs and financial pressures affecting the sector. Additionally, producers across Turkey are reporting low yields, with weather conditions and the unfavorable exchange rate contributing to the challenges faced by the industry.

Turkey faces a sharply reduced olive oil campaign, with production expected to fall well below last year’s record 475,000 tons.

Growers and officials attribute the decline to the trees’ natural biennial cycle and unusually harsh weather during flowering, which damaged fruit set across major producing regions.

“The 2025/26 National Olive and Olive Oil Harvest Forecast and Assessment Committee has determined that Turkey will produce 310,000 tons of olive oil and 740,000 tons of table olives in the 2025/2026 production season,” said Mustafa Tan, chairman of the Turkish National Olive and Olive Oil Council (UZZK). “As in all countries, these estimates may be revised as the harvest progresses and concludes.”

Tan noted that early-season damage from cold weather and drought began to ease after October’s consistent rainfall. “As the olives absorbed sudden water, they grew larger, humidity increased, and the olive oil yield ratio began to range between 1/6 and 1/9,” he said.

He expects yields to improve as the harvest advances. Factoring in remaining stocks and projected output, he estimated that more than 500,000 tons of olive oil will be available to Turkish producers and exporters by the end of the season.

Still, Tan acknowledged that rising costs and financial pressures continue to weigh on the sector. “As in every country, increasing production costs and financial difficulties are negatively affecting producers, industrialists, and exporters,” he said. “The sector is waiting for interest and help in every branch.”

The International Olive Council (IOC) projected an even lower national yield in its October outlook, estimating a range of 280,000 to 290,000 tons for 2025/26.

Some analysts anticipate a far deeper drop. Agriculture journalist Ali Ekber Yıldırım reported that most producers, traders, and millers he interviewed expect between 150,000 and 180,000 tons. “One or two people suggested that with the recent rains, it could reach 200,000 tons,” he said.

Alper Alhat, chairman of the Akhisar Commodity Exchange, also forecast production below 200,000 tons, likely between 170,000 and 180,000 tons. “This year, the yield will be low but quality will be high,” he noted.

Producers across Turkey cited severe weather as the dominant factor behind the poor outlook. “A very harsh winter last year and the summer drought have negatively impacted the olive yield,” said İsmail Şahin of Zagoda Olive Oil. “The yield this season is very low, well below our expectations. This low yield applies to all of Turkey, which will cause prices to rise.”

Şahin grows Arbequina and Trilye olives on his family farm in Manisa, one of the country’s main producing areas. He said the unfavorable exchange rate — where the Turkish lira continues to lag behind inflation — has further eroded producers’ competitiveness. “This will make it very difficult for Turkish olive oil to compete with olive oils from other countries in international markets,” he said.

In Mut, a major producing zone in Mersin province with 10 million olive trees and 21 mills, expectations are similarly subdued. “This year, our olive yield is very low due to the weather conditions,” said local producer Mehmet Çaltı.

Mut Agricultural Chamber chairman Muharrem Yılmaz said the region will likely produce around 10,000 tons of olive oil — down from more than 30,000 tons in abundant years — due to insufficient rainfall.

Further west in Aydın, producers expect a sharp decline from last year’s volumes. The combination of low yields and price instability, they said, has made the season particularly difficult.

From his groves in Muğla’s Milas district, Mark Colin of Oro di Milas reported the same pattern: lower output but promising quality. “The inconsistent weather — early heat, long dry spells, and winds that came at the wrong time — reduced the fruit set,” he said. “High-mountain, non-irrigated groves feel these stresses even more.”

“But at the same time, I expect remarkable quality,” he added. “The olives that remain on the trees this year are strong, aromatic, and vibrant. Our trees live purely on rainwater and the strength of the rocky, mineral-rich soil. This gives our oils a unique intensity, but it also makes us more vulnerable to climate shifts.”

Colin said that beyond climate pressure, producers in Milas face another growing threat: mining activity. “My biggest emotional and environmental concern this season has been the mining activity approaching dangerously close to my groves,” he said. “As an organic producer, the idea of industrial expansion near these ancient trees is heartbreaking. These groves are part of the identity of Milas.”

The concern follows a controversial law passed this summer permitting the use of forests and farmland for mining operations. The measure designates 23,000 hectares in Milas — about one-tenth of the district — as essential lignite-mining areas. The region is widely known for its olive groves and is home to Milas olive oil, one of just three Turkish olive oils with Protected Designation of Origin (PDO) status in the European Union.

Colin added that wildfires and erratic weather remain persistent dangers. “Every summer we face the fear of wildfires, especially in the high mountains,” he said. “On top of that, rising temperatures and unpredictable rainfall continue to challenge us as dry-farmers.”

“My goal is to honor Milas, protect its olive groves, and share its exceptional oils with the world,” he said. “If my work can help bring even a little more attention to the beauty and importance of this land, then I consider myself successful.”