European Commission Predicts an Upward Trend in Production After This Year's Setback

Production and exports are expected to surge in Spain and Portugal. Italy will see modest production gains and fewer imports. Production in Greece is projected to fall.

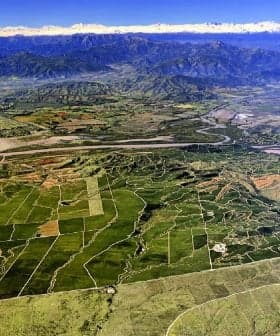

Valpaços Cooperative, Portugal (OOT Archive)

Valpaços Cooperative, Portugal (OOT Archive) The European Commission estimates that olive oil production in the European Union for the 2021/22 crop year will be 1.98 million tons, with Spain leading production. The commission expects annual olive oil production to reach 2.5 million tons by 2031, driven by improved profitability and value creation, but warns that climate change may pose challenges for growers.

Olive oil production in the European Union is expected to reach 1.98 million tons in the 2021/22 crop year, according to preliminary estimates from the European Commission.

Unsurprisingly, Spain is expected to lead the way with 1.3 million tons of production, followed by Italy (315,000 tons), Greece (235,000 tons), Portugal (120,000 tons), Cyprus (6,100 tons), France (4,605 tons), Croatia (3,044 tons) and Slovenia (280 tons).

Water scarcity and competition with other uses could remain a challenge for future yield development which is due to increase by one percent per year until 2031.

Updated last month, the commission expects this year’s production will be significantly lower than the 2.23 million tons produced in the 2020/21 crop year and five percent below the rolling five-year average.

See Also:2021 Harvest UpdatesIn a separate report, the commission struck a more optimistic tone about the future, expecting average annual olive oil production to rise to 2.5 million tons by 2031, a 22-percent increase compared to 2020.

According to the commission, the growth will be fueled by “improved profitability and value creation.”

“The recovery of E.U. olive oil prices in 2020/21 has stimulated investments into new olive tree plantations,” the commission experts wrote. “Behind this, the value creation in broader terms remains significant, leading to improved profitability especially in super-intensive (super-high-density) systems.”

However, the commission also warned that climate change will remain a challenge for olive growers and is likely to increase annual yield variations and affect oil quality.

“To manage this, resistant varieties are expected to replace current ones,” the commission experts wrote. “Meanwhile, water scarcity and competition with other uses could remain a challenge for future yield development which is due to increase by one percent per year until 2031.”

Generally, the commission expects to see heterogeneous growth across eight main olive oil-producing countries in the 27-member bloc.

“In particular, annual average production increases in the range of 2.5 percent to five percent are expected in Spain, Italy and Portugal,” the commission experts wrote. “A limited decline in production is expected in Greece reflecting a combination of a small area decline with a lagging yield development.”

“The Covid-19 pandemic has also affected the sector, which was facing labor shortages in the course of 2020, especially in less-mechanized harvest systems,” they added. “Diseases such as Xylella fastidiosa and weather and climatic events (e.g. heat waves and droughts) are the key uncertainties that could prevent the realization of the expected production increases.”

The commission also anticipates extra‑E.U. exports to grow along with the world’s appetite for olive oil, rising to one million tons by 2031. Currently, the E.U. exports about 650,000 tons of olive oil each year.

“As per capita consumption remains low in the main E.U. export destinations, the potential for growth is high,” the commission experts wrote. “Therefore, exports will expand and take a larger share of the available oil. Consumption growth in the E.U. is due to be driven by non-producing countries.”

“The value creation should be sustained via exports of bottled and high-quality olive oil (including organic) even if some commoditization might not be prevented,” they added. “E.U. imports could remain high, reflecting increasing production in non‑E.U. countries.”

Packaging plant of the cooperative of Valpaços, Portugal

The commission estimates that extra‑E.U. olive oil exports will increase the most in Portugal and Spain, growing by three percent and nine percent, respectively.

“Overall, Spain is expected to remain a key player in the global olive oil market, which could use the projected expansion of production capacities to satisfy the emerging demand from the Asia-Pacific region in particular,” the commission experts wrote. “Moreover, exports of Spain and Portugal to Brazil have shown a potential to grow.”

Meanwhile, Greece is also expected to see a slight dip in exports by volume – though is projected to maintain a steady amount of exports by value – due to its predicted production decrease.

Across the Ionian Sea, Italy is expected to see its imports decline as a result of its own projected production increase.

While the commission remains optimistic about extra‑E.U. trade, they estimate a slight decline in per capita olive oil consumption in the main producing countries, with annual declines estimated to be between 0.4 percent and 0.6 percent.

“This decline reflects the maturity of the market and different consumption styles of younger generations,” the experts wrote.

However, they anticipate overall consumption to grow as non-Mediterranean E.U. member states drive demand for olive oil. The commission attributed increasing awareness of olive oil’s health benefits and the growing popularity of the Mediterranean diet for both of these changes.

Share this article