Can China Become a Major Olive Oil Producer?

China's growing demand is helping move forward domestic production.

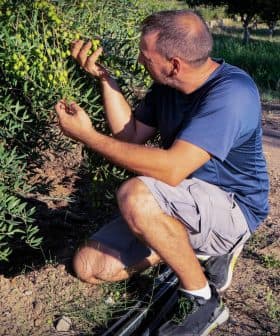

Farmland in the Jinsha River Valley, China

Farmland in the Jinsha River Valley, ChinaChina’s growing demand for olive oil has led to the rapid development of a domestic olive oil industry, causing concern among traditional producers. The Chinese government has implemented a national strategy to boost olive oil production, aiming to meet consumer demands and improve the living conditions of local farmers.

China’s growing demand for olive oil is accelerating the development of a domestic olive oil industry at a pace that appears to start raising alarm among traditional olive oil producers.

In 2013, Spanish daily El Mundo predicted that it would take China a couple of years to move from 39 million olive trees to 59 million, matching the area of planted olive orchards in Jaén, where most of Spain’s olive groves are. This month, Spanish financial newspaper El Economista confirmed this figure had been reached.

Healthy eating habits have become increasingly important for Chinese consumers making olive oil a highly appreciated food. Additionally, travel to countries as Spain or Italy has introduced them to this product with a great market potential considering the growth of China’s middle-class urban population.

To meet growing consumer demands the Chinese government implemented an aggressive national strategy to boost its domestic olive oil industry, launching a plan for the development of olive trees. Olive cultivation is also meant to improve the living conditions of local farmers, preventing their migration within the country and minimizing depopulation.

© Olive Oil Times | Data source: International Olive Council

Large-scale olive growing in China began in the 1960s and went through additional phases which, according to the International Olive Council, increased trees from 70,000 in 1973 to 23 million in 1980. In 1979, more plants were introduced, including European varieties, which were distributed for grafting and regional testing in several provinces, a crop that helped advance a Chinese olive oil industry that began to thrive at the beginning of the millennium.

“Chinese planted many olive varieties, all known and respected. The most important were Picual and Arbequina, from Spain; Liccino, Frantoio, Coratina and Ascolana Tenera from Italy; and Koroneiki, from Greece,” said Santiago Botas, an olive oil expert from Spain.

Botas reported that studies conducted by the Mountain Hazards and Environment Institute revealed that regions with the greatest potential for olive tree cultivation were the Bailong River Valley, in Southern Gansu, and the Jinsha River Valley, in the border of Yunnan and Sichuan.

Whereas planted areas are quickly expanding, the most recent plantings will need time to mature and become fully productive for quality oils on a large-scale production. Pluviometry is a major difference between China and the Mediterranean, as it not only rains more in China, but it is also during summer when it rains the most.

Longnan, Guansu Province

These differences, along with higher Ph soils in China, may cause problems in the fruits, leaves, roots, and the yields because of the impact heavy summer rains might have on flowering. This means that China will still need to import olive oils for a while to meet consumer demands. Mid- to long-term, though, China’s large territory, very cheap labor costs, and scientific approach may constitute competitive advantages to advance plantations and production.

China’s olive oil industry is still incipient, but according to Botas, there are signals of a growing interest to produce extra virgin olive oils with a good sensorial quality. Towards this end, some companies have incorporated international consultants to help improve their production. Others have even visited countries as Spain to learn about the business.

Two signs of the progress made by Chinese olive oils are awards in international oil competitions. In 2017 a robust olive oil from French cultivar Picholine won a Gold Award in the NYIOOC World Olive Oil Competition. In 2018 a Chinese olive oil won in the ripe fruitiness category in the Mario Solinas Awards.

Extra virgin olive oils currently dominate the Chinese production, with a small percentage of virgin oils. In the 2016/17 campaign, approximately 5,000 tons of olive oil were produced, a figure that doubled that of 2014/15. It is estimated that the 2017/18 campaign will attain 6,000 tons.

“I believe domestic production is a good platform to develop markets more quickly as it happened in South Africa, Australia, New Zealand or the United States,” said Botas, who suggested that as Chinese consumers learn more about olive oils and their culinary applications in Chinese cuisine, demand will increase even more, offering more opportunities for olive oil producers from all over the world to have a piece of the Chinese market.