5.7K reads

5.7K readsNews Briefs

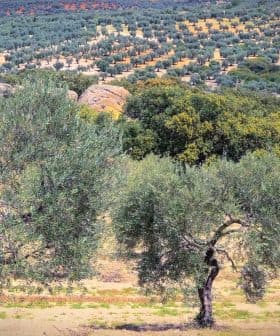

European Union Olive Oil Production Set to Grow by One-Third

The European Commission predicts that olive oil production in the European Union will increase by 32 percent for the 2024/25 season, with Spain expected to lead the way, while Italy’s production is forecasted to decline significantly. Despite high prices impacting exports and consumption, the E.U. anticipates that overall consumption could rebound by as much as seven percent if prices continue to decrease.

The European Commission’s latest projections suggest that the 2024/25 crop year will return to more typical yields following two challenging years.

According to Brussels’ recently published agricultural short-term outlook, olive oil production across the European Union is expected to increase by 32 percent compared to last season.

This rise will bring the estimated total yield for the upcoming season to two million tons. In contrast, 2023/24 saw production drop to 1.53 million tons, with 1.39 million tons recorded in 2022/23.

See Also:2024 Harvest UpdatesSpain is set to be the most significant contributor, with a forecasted yield of 1.3 million tons, though experts in the country said production may reach up to 1.45 million tons.

Meanwhile, Portugal and Greece are expected to increase olive oil production.

Conversely, Italy is expected to face a significant downturn, with its production forecasted to drop by one-third.

Starting stock levels for 2023/24 fell to 410,000 tons, down from 671,000 tons in the previous year. As the new season begins, stock levels have dropped to 350,000 tons.

Nonetheless, the E.U. anticipates that stockpiles will recover to more than 600,000 tons by the season’s end, aligning with average historical levels.

The expected surge in olive oil availability is likely to influence prices.

Olive oil prices have only slightly decreased since their peak in January 2024, reflecting expectations for a bountiful harvest.

For example, according to the E.U.‘s Agriculture and Rural Development Department, extra virgin olive oil prices in Spain fell from €9.03 per kilogram to €7.43.

Still, this remains significantly higher than the five-year average of €5.05 per kilogram.

High prices have also impacted exports. E.U. olive oil exports started to decline during 2022/23, showing only slight signs of recovery by the end of 2023.

Between October 2023 and July 2024, exports were down 1.3 percent compared to the previous season and 26 percent lower than in 2021/22. However, a ten percent rise in exports is anticipated for the new season.

Imports, on the other hand, are expected to drop by seven percent.

Despite this, solid yields and competitive prices in Tunisia and Turkey could shift the outlook as the season progresses. In the last season, E.U. olive oil imports rose by 30 percent, with 62 percent coming from Tunisia and 14 percent from Turkey.

The short-term outlook report also highlighted considerable uncertainty in the market, particularly regarding the rate of price decline and its effect on consumers.

Some consumers have either reduced their use of olive oil or stopped purchasing it entirely due to high prices.

According to the E.U., with prices still elevated, olive oil consumption is expected to drop by one percent further, leaving it 23 percent lower than in 2021/22.

However, if prices at origin continue to decrease and those reductions are passed on to consumers, overall consumption in the E.U. could rebound by as much as seven percent.

E.U. data show that consumption in Spain, Italy, Portugal and Greece could almost reach 987,000 tons in 2024/25, up from the 923,000 tons of the previous season.