Olive Oil Production, Exports Smash Records in Uruguay

In 2019, Uruguay quadrupled its olive oil production relative to the previous year. As trees come into maturity, production is likely to continue trending upwards.

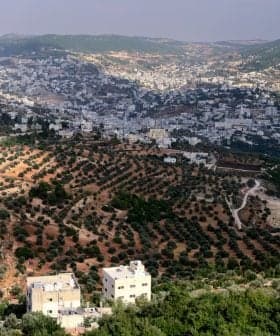

Plaza Independencia, Montevideo.

Plaza Independencia, Montevideo.Uruguay experienced a record-setting olive oil harvest in 2019, producing 2,775 tons of extra virgin olive oil, an increase of over 360 percent from the rolling five-year average. As production and exports of olive oil in Uruguay continue to grow, the country is looking to expand into new markets such as Brazil and China, where prices for Uruguayan olive oil are substantially higher than in Spain and the United States.

Olive oil producers in Uruguay enjoyed a record-setting harvest in 2019, according to a new report compiled by Uruguay’s Ministry of Ranching, Agriculture and Fishing.

The small South American country produced 2,775 tons of extra virgin olive oil, according to the report, an increase of more than 360 percent over the rolling five-year average.

Uruguay has entered a new stage of its olive growing because of the aforementioned (tree cultivation). It has overcome the barrier of producing 1,000 tons of olive oil annually.

“The 2019 productive harvest was much higher than the previous records and even exceeded the expectations that the producers had,” the report said. “Climatic conditions allowed a very good flowering and consequently a great quantity of fruit, with a good quality of oil.”

In addition to favorable weather, Jorge Pereira, an Uruguayan olive oil sommelier and consultant, told Olive Oil Times many olive trees that had been planted last decade were just now beginning to bear fruit.

See Also:Record Year for South Americans at NYIOOC“The increase in cultivated area in the period of 2010 to 2019 has quintupled, and these new olive trees have entered production,” he said.

Uruguay’s olive oil production is also expected to continue climbing. Previously, the production ceiling sat at around 1,000 tons with off-year harvests dropping to about 500 tons. Now, Pereira expects to see Uruguay producing a minimum of 1,000 tons per year, even in off-years.

“Uruguay has entered a new stage of its olive growing because of the aforementioned [tree cultivation],” he said. “It has overcome the barrier of producing 1,000 tons of olive oil annually, although it is also far from expected for the approximately three million olive trees planted in the country.”

“What continues to influence [the harvests] are seasonal factors such as alternation and climatology,” Pereira added. “2020 by regional meteorological phenomena, especially the low winter temperatures when flowering begins, will have a significantly lower production, but with that minimum of 1,000 tons.”

As production in the small South American country – which is home to just under 3.5 million people and 22,500 acres of olive trees – has increased, so have exports. The Ministry of Ranching, Agriculture and Fishing reported that exports approached 1,000 tons and generated revenue of $2.5 million.

Spain led the way as the largest destination for Uruguayan olive oil, with about 71 percent of the country’s exports headed across the Atlantic to the Iberian Peninsula. The United States (24 percent), Brazil (four percent) and China (0.5 percent) were the four next largest destinations.

Pereira said that exports would continue to grow along with production. Domestic consumption in Uruguay remains quite low – about 500 milliliters per person per year – so Pereira views growing exports as necessary for the survival of the country’s 147 producers.

The recently signed European Union-Mercosur free trade agreement will provide Uruguayan exporters tariff free access to all 28 members of the E.U., when it comes into force in the next few years. In addition to the already established market of Spain, Uruguayan exporters will also have the opportunity to export to northern European countries, where demand for olive oil is growing steadily.

The threat of more American tariffs on Spanish olive oil imports will also leave the world’s third largest olive oil consuming country in need of sourcing new imports, with distributors in the country already looking south to neighboring Argentina.

Both of these international developments present opportunities for Uruguayan producers to continue establishing themselves in the country’s two largest olive oil export markets.

However, Brazil and China may present the best opportunity for Uruguayan producers. Both countries pay substantially more for Uruguayan olive oils. Brazil pays an average of $6,376 per ton while China pays $8,258 per ton. By contrast, Spain and the United States pay considerably less: $2,516 and $1,908 per ton, respectively.

Due to its proximity and unrestricted access, Pereira believes that the rapidly growing Brazilian market will become the most important one for Uruguayan exporters.

“In the short term the large market that can change this relationship in exports is Brazil, which demands 80,000 tons per year of olive oil, he said. “Due to geographical proximity, attractive prices and non-existent customs tariffs, it will become an increasingly significant destination.”

As exports have grown, imports appear to be declining. The Ministry of Ranching, Agriculture and Fishing said that from January to October, imports hit a five-year low.

Officials from the Uruguayan Olive Association would like this figure to continue decreasing and have started to promote domestic oils. However, consumer preferences for imported olive oils remains quite strong.

“The productive sector has not been able to counteract the competition of foreign oils or increase domestic consumption.” Pereira said. “The lack of national policies to value Uruguayan olive oil and promote consumption are pending tasks.”

“My assessment is based on the fact that 2019 was a year that the country could have achieved the self-sufficiency of olive oil consumption,” he added. “However, Uruguay mainly imported olive oil from Argentina [and Spain] at prices that are double what it obtains from exports.”