Despite Tariff Exemption, Greek Producers Struggle to Export Their Oil

With U.S. tariffs on some Spanish olive oil imports coming into force, Greek producers should have an advantage over Spain. However, the nation has not been able to profit from exporting its olive oil reserves.

Greek olive oil has been exempted from U.S. tariffs on European Union imports, following lobbying efforts by the Greek Minister of Agricultural Development and Food. This exemption was granted due to Greece not being involved in the Airbus ownership group, leading to a favorable outcome for Greek olive oil producers.

Greek olive oil has been exempted from the list of retaliatory tariffs that was imposed by the United States on $7 billion worth of European Union imports earlier this month.

This result comes after months of lobbying by the Greek Minister of Agricultural Development and Food, Makis Voridis, to exempt Greek table olives and olive oil from the U.S. tariff list.

Most of the Greek producers want to do everything by themselves…but they do not have the quantities to guarantee long-term cooperation with big markets.

The tariffs stem from a dispute between the U.S. and E.U. about subsidies for the European aircraft manufacturer Airbus. Voridis argued that since Greece was not a part of the Airbus ownership group, the country’s olive oil should be exempt from U.S. tariffs.

The Office of the U.S. Trade Representative agreed and said Greek table olives and olive oil will not be on the list of items subject to the increased import taxes.

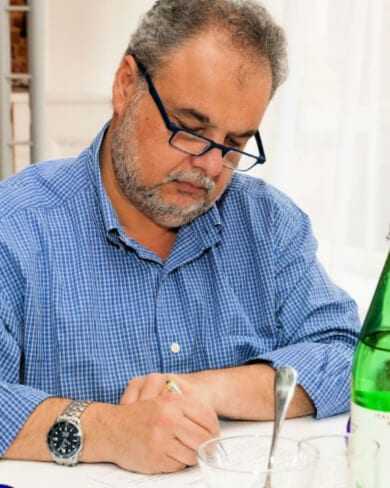

See Also:Olive Oil Trade NewsKostas Liris, a Greek agronomist and olive oil expert, told Olive Oil Times that Greek olive oil producers can benefit from the tariff exemption, especially with U.S. tariffs on competing Spanish oil.

“[The] U.S. tariff exemption could be a big opportunity, especially with the problems that they will create for Spain,” Liris said. “Yes, it could make a difference if Greek producers are able to benefit from them.”

While Greek producers should have an advantage over those from Spain, the nation has not been able to profit off exporting its olive oil reserves.

Greece is the third-largest producer of extra virgin olive oil, but produces more than it sells. Most Greek olive oil is exported in bulk to Italy, which blends the oil with its own and sells it on the international market.

According to the National Bank of Greece, only 27 percent of the country’s olive oil is exported explicitly as Greek olive oil, so few Greek farmers directly benefit from the sale of the product.

Kostas Liris

Liris added that Greek olive oil is at a disadvantage because of lower-priced competition from other nations.

“It is impossible for Greek producers to trade, [especially] with the prices at the moment and when they have to compete with Spanish and Tunisian bulk olive oil,” he said.

The Greek financial crisis has also played a part in the export of olive oil not being as profitable as it should be for the nation’s producers. Due to the financial crisis in 2009, Greek olive oil was sold to Italy at rock-bottom prices and this led to the deterioration in Greek olive farmer cooperatives, according to Liris.

“Greek olive oil cooperatives do not exist anymore,” Liris said. “The most important ones have been bankrupted over the last years. Only a few remain and all of them are very small. In the past [few] years, the most important ones have been sold or the banks have confiscated their facilities.”

Many Greek olive farmers are reluctant to band together and often become independent producers as a result. Liris said that the lack of cooperation among Greek olive oil farmers hurts the industry.

“Most of the Greek producers want to do everything by themselves,” he said. “They do not like synergies. They try to sell and to export alone, sometimes with excellent results, but they do not have the quantities to guarantee a long- term cooperation with big markets.”

While the Greek olive oil industry is in flux, Liris believes that with better prices, more consistent oil quality, and greater cooperation among producers, Greek olive oil farmers can thrive.

“Quality, consistency, quantity and correct prices are the elements that are necessary to provide profits [to Greek olive oil farmers],” he said. “Greek producers have to understand that the need synergies in order to have a chance to get really big clients. Selling olive oil was never easy, but there is always a place in the market for everyone.”