Climate Chaos Wreaks Havoc on Chilean Harvest

Olive oil production in Chile dropped significantly in 2024 due to high temperatures and rain during the harvest season, resulting in a 29 percent decrease from the previous year. Despite the production decline, Chilean exporters have taken advantage of high prices in Europe and the Americas, with Brazil and the United States being the main destinations for Chilean exports.

Olive oil production in Chile has fallen to its lowest levels since 2013 after high springtime temperatures and rain during the harvest hampered farmers and millers across the country.

“Olive oil production during the 2024 season reached 15,000 metric tons,” said Gabriela Moglia, the general manager of ChileOliva, a producer association. “This represents a decrease of 29 percent concerning the tons of oil obtained in 2023” and is 33 percent below the five-year average.

“The main challenges were the intense rains in the harvest months,” Moglia added.

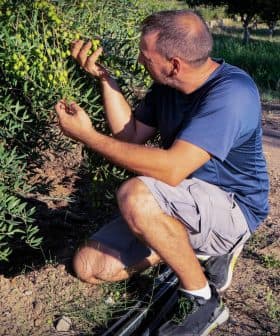

See Also:2024 Harvest UpdatesAccording to Jorge Astudillo, an olive oil production consultant, high winter and spring temperatures associated with El Niño in the country’s north damaged many olive trees as they were blossoming.

“Production in the Coquimbo area, 300 kilometers north of Santiago, in particular… has practically come to zero or near zero,” he told A ambos lados de la mesa, a podcast. “It is a very important area… Twenty percent, if not more, of the production comes from this area.”

“But in the rest of the country, it was a normal year in terms of production,” Astudillo added. “Although early rainfall affected the harvest, and there was frost in other areas.”

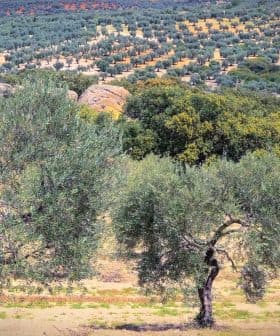

Olive growing spans the entire northern half of Chile, stretching about 2,000 kilometers from the Azapa Valley near the Peruvian border to the central Maule Valley.

As a result, producers on opposite sides of the second-largest olive oil-producing country in the Americas face various challenges.

Along with unseasonably warm weather, growers in the north of the country are combating Mediterranean fruit fly infestations. The invasive species, thought to have been introduced via smuggled fruit from Peru, has “caused havoc” across olive groves on both sides of the border.

Meanwhile, in the Maule Valley, Las Doscientos general manager José Pablo Illanes said the company experienced a 20 percent production decrease, attributing the decline partly to many trees entering an ‘off year’ in the natural alternate bearing cycle of the olive tree and some impact from the climate.

The company’s harvest started in May and lasted for 70 days, longer than usual due to persistent rains. Even so, Illanes is most concerned about the potential for long periods of drought.

“Learning to live with climate change is everything,” he said. “We know that, above all, the issue of water is what is most worrying when looking to the future.”

Fernando Carrasco Spano, the chief executive of Olivos Ruta del Sol, whose groves are about 100 kilometers north of the Maule Valley, confirmed that climatic conditions resulted in a lower yield.

“This year, we had a seven percent drop in yield,” he said. “The olives did not achieve the oil concentration of previous years. The total kilograms of olives were very good, but their yield was very low.”

“The main challenge this season was to balance the harvest time vs yield,” Carrasco Spano added. “On the one hand, we wanted to harvest early to avoid the risk of frost. On the other hand, we wanted to wait a few days or weeks for the olives to continue accumulating oil. Ultimately, we achieved a good result and a valuable 2024 campaign.”

Despite the dramatic production decline, Chilean exporters have taken advantage of consecutive poor harvests in the Mediterranean basin and the consequent historically high prices in Europe and the Americas.

“During the first half of 2024, that is, from January to June, $38,165,119 (€34,347,980) FOB value were exported, representing an increase of 50 percent compared to the same period in 2023,” Moglia said.

“Regarding the volume of olive oil shipments abroad, in the first half of 2024, a total of 4,176 tons of olive oil were shipped, representing a two percent decrease compared to the same period in 2023,” she added.

Brazil and the United States remain the main destinations for Chilean exports, representing 58.4 and 23.1 percent by value, respectively. Spain represents the third leading destination, making up 7.4 percent by quantity.

“There has been greater demand from markets like Brazil,” Illanes confirmed. “The fact that production in Spain has decreased for the last three consecutive years due to drought has caused the world’s oil stock to decrease and led to greater demand from nearby markets.”

“Our exports grew by 33.4 percent, both in value and volume,” Carrasco Spano added.

Due to steady global demand and diminished production, olive oil prices in Chile have increased significantly.

According to Astudillo, the price for a producer-branded bottled half liter of olive oil is about 7,500 Chilean pesos (€7.30). He estimates Chileans consume between 900 milliliters and one liter of olive oil per capita.

“The price of bottled oils on the shelves [has doubled], so the market has been forced, especially the final consumer, to look for larger or cheaper formats,” he said.

While no official data on domestic olive oil consumption have been published this year, Astudillo added, “we see that there is a decrease in consumption at the local level.”

Still, Illanes said Las Doscientos, which sells about 50 percent of its olive oil in Chile, did not see a fall in demand compared to the reduction in supply.

“Regardless of the price, which rose a lot, demand never fell in the same proportion as supply,” he said. “Now we know that demand was maintained while reaching these price levels. This gives us peace of mind knowing that people value olive oil as part of their basic household basket.”