Producers in Portugal Anticipate Another Bumper Harvest

Production could reach 190,000 tons after a wet winter replenished aquifers. However, labor remains a challenge for some growers.

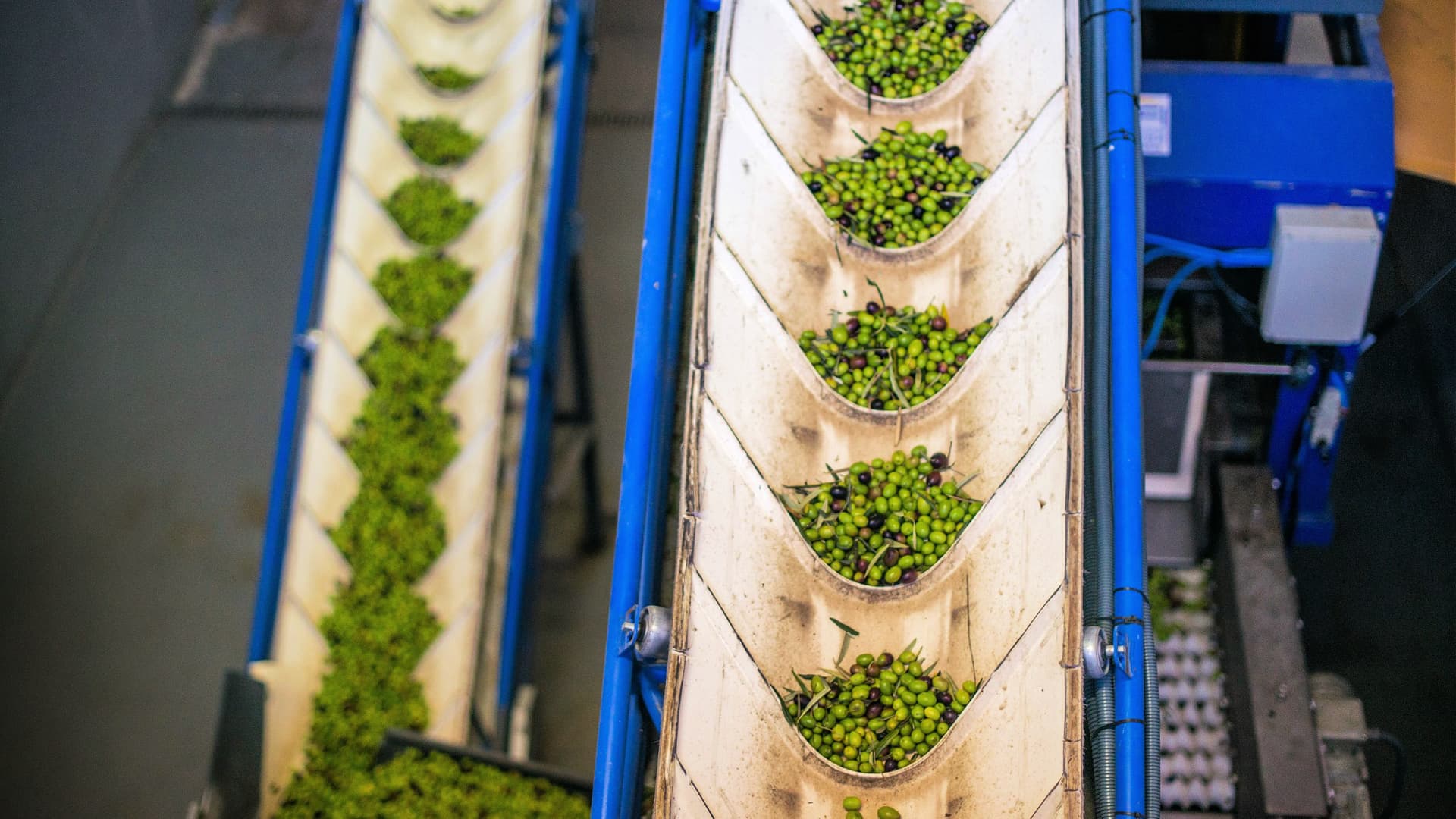

Portugal is expected to experience its second-highest olive oil production in the 2024/25 crop year. (Photo: Acushla)

Portugal is expected to experience its second-highest olive oil production in the 2024/25 crop year. (Photo: Acushla) Portugal is expected to achieve its second-highest olive oil production in the 2024/25 crop year, with estimates ranging from 170,000 to 190,000 metric tons. While some regions like Trás-os-Montes anticipate a modest production increase, challenges such as labor shortages and handling olive pomace remain concerns for the industry.

As the harvest gets underway, olive farmers and millers in Portugal anticipate the country will achieve its second-highest olive oil production in the 2024/25 crop year.

According to Mariana Matos, the secretary general of Casa do Azeite, a producer association, Portugal is expected to produce between 170,000 and 190,000 metric tons of olive oil in the 2024/25 crop year.

If it comes to fruition, the harvest would significantly exceed the five-year average of 146,060 tons but finish below the record-high 206,200 tons recorded in 2021/22.

See Also:2024 Harvest Updates“The campaign has just begun, but a recovery in production is expected in the more traditional olive growing regions, given that the climate was more favorable throughout the production cycle,” Matos said.

“Specifically, it rained more than in the previous two years,” she added. “The difference may not be so significant regarding the modern and irrigated olive groves.”

From the traditional steep slope groves in Trás-os-Montes to the super-high-density plantations in Alentejo, producers across Europe’s fourth-largest olive oil producer confirmed they anticipate production will remain steady or increase.

However, some warned that too much rain during the harvest could result in lower-than-expected olive oil production and impact quality.

The early harvest was hampered by rain that some producers worry may impact quality. (Photo: Acushla)

Alberto Serralha, the chief executive of Sociedade Agrícola Ouro Vegetal (SAOV) in central Portugal, said the company started harvesting on September 24th and is expected to complete it by November 10th.

While SAOV and its partners were harvesting more olives, he said lower oil accumulation in the fruit was not necessarily leading to more olive oil production.

“The weather has been cooler than last year, helping quality,” he said. “Still, rainfall has made us lose 12 days of harvest, significantly disturbing our oil sales and milling operation.”

Still, Serralha said production is expected to increase in the wider region. “The production is higher than last year,” he said.

“There are challenges with quality, though, as 12 days of persistent rainfall triggered anthracnose, affecting the most susceptible varieties,” Serralha added. “Those who delayed the harvest are now facing quality problems and fruit losses on the ground.”

He characterized the estimate of 180,000 tons as optimistic, adding that the confluence of many factors in Portugal makes forecasting the final yield a highly speculative practice.

“It is hard to estimate a farm [let alone] a country,” Serralha said. “The permanent expansion of olive groves in Portugal makes it even harder. Considering the low oil yields and the productivity decline of older super-high-density orchards, 180,000 tons is within the range of my most optimistic scenario.”

“If anthracnose hits hard, it can end similarly to last year,” when Portugal produced 157,600 tons, he added. “Despite the significant new areas coming online every year, this will be the third season below the record in 2019.”

In the northern region of Trás-os-Montes, farmers and millers anticipate a modest production increase due to plentiful winter rainfall, which has broken the country’s historic drought.

Joaquim Moreira, a spokesman for Acushla, said the company anticipates olive oil production will increase by 15 percent. He said newly planted groves are entering maturity, along with the rain.

“In Trás-os-Montes, the increase will not be so strong – probably just five percent more than the previous year,” he said. “We had worse climate conditions.”

Moreira added that he expects production to continue trending up at Acushla and Portugal as newly planted groves enter maturity.

Manuel Norte Santo expects production to be similar to last year’s yield, which was the secod-hightest in the country’s history. (Photo: Est. Manuel Silva Torrado)

Producers also expect another good harvest in the vast southern region of Alentejo, which is responsible for the overwhelming majority of Portuguese olive oil production. However, not all producers expect this year’s yield to exceed last year’s.

“The situation is pretty similar to last year,” said Manuel Norte Santo, the export manager of Est. Manuel Silva Torrado. “However, in traditional olive groves, this late rain created some difficulties with pests, and some olives began to fall.”

Norte Santo anticipates that the company, which boasts 200 hectares of groves and purchases olives from other farmers, will produce consistently with its super-high-density groves.

“In traditional cultivation, there is greater volatility, but this year, the forecast should be like last year,” he added. “However, as the price of olive oil will be lower than last year, some producers with small areas of cultivation may not harvest their olives, causing the numbers to drop slightly.”

As a result, Norte Santo agreed with Serralha that the current production forecast may be optimistic and said the picture would become more apparent as the harvest continues.

Elsewhere in Alentejo, 4 C Azeites chief executive Francisco Lopes said his harvest is already underway and expects production to be similar to previous years. The company produced 6,900 liters of olive oil in the 2023/24 crop year.

Producers in Alentejo expect thisyear’s harvest to be similar to last year’s or slightly better. (Photo: 4 C Azeites)

“In Alentejo, the year looks promising with volumes somewhat higher than in 2023 thanks to the increased areas planted with super-intensive olive groves that will come into production,” he said.

While some producers in Alentejo anticipate a similar harvest, others have experienced a production increase as new olive groves mature and other groves enter an ‘on-year’ in the olive grove’s natural alternate bearing cycle.

On and off years

Olive trees have a natural cycle of alternating high and low production years, known as “on-years” and “off-years,” respectively. During an on-year, the olive trees bear a greater quantity of fruit, resulting in increased olive oil production. Conversely, an “off-year” is characterized by a reduced yield of olives due to the stress from the previous “on year.” Olive oil producers often monitor these cycles to anticipate and plan for variations in production.

Teresa Teixeira, the assistant director of Olivum, an olive farmer association, confirmed that its members expect a 20 percent production increase compared to last year.

“In the past year, the olive oil production of Olivum members was 105,000 tons,” she said. “This year, we predict that the production will be in the order of 125,000 tons. So, 180,000 tons is more or less what we had predicted for the national production.”

While farmers and millers enjoyed favorable conditions leading up to the harvest, Matos warned that producers would likely face a familiar challenge as the harvest progressed.

“During the harvest, one of the main challenges is the issue of labor, which can be a problem in certain regions, especially in the more traditional olive groves… where mechanical harvesting is impossible,” Matos said. “In Portugal, these olive groves are found in the northern and central regions.”

“In modern olive groves in the Alqueva region, in Alentejo, these problems are not so pressing, as they are irrigated, and harvesting is completely mechanized,” she added.

Along with the lack of labor, Teixeira added that the proliferation of high-density and super-high-density groves has resulted in an exponential increase in olive pomace production without a corresponding increase in infrastructure to treat and dispose of the olive oil production byproduct.

“In the past years, there was a huge increase in production, and the extraction industries don’t have the capacity to receive all the olive pomace,” she said. “Another problem is the lack of specialized labor for new technology.”

Share this article