Robotic Olive Harvesters Might Be on the Horizon

Google's parent company is investing in agricultural robots that could someday be used to harvest olives.

9.0K reads

9.0K readsAbundant Robotics in California is developing a fruit-picking robot that uses artificial intelligence to harvest fruit, starting with apples but potentially expanding to olives, which could have significant implications for labor-intensive industries like agriculture. The cost of seasonal labor in olive harvesting may remain low due to high unemployment rates in countries like Spain, Italy, and Greece, but the increasing competitiveness and efficiency of automated harvesters could lead to widespread adoption in the near future.

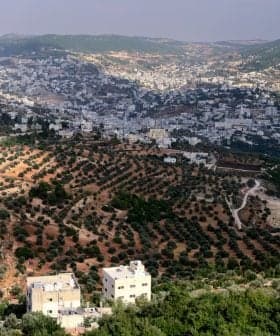

The future of agriculture is fast approaching and could dramatically affect olive oil production costs. Abundant Robotics in Hayward, California is prototyping a fruit-picker that employs artificial intelligence to determine the optimal time to pick fruit as it vacuums the product into a collection bin.

The machine is currently being tested on apples, but the company founders anticipate branching out into other fruit in the future.

After securing a $10 million investment from Google Ventures, Yamaha Motor Company, and others, Abundant Robotics is poised to disrupt traditional agricultural methods for harvesting, including olives.

While the company’s current focus is on apple orchards in the United States and Australia, its vacuum harvesting technology could also prove to be useful for olives, which are traditionally picked by hand because of their delicate skin.

Using complex algorithms, Abundant’s harvesting robot can distinguish a piece of fruit from its surrounding leaves. Next, through a number of visual variables, the robot can determine whether the fruit has achieved optimal ripeness and make the decision to pick it.

The harvester then aligns its vacuum and removes the fruit from the tree. The machine can harvest around the clock, using special imaging technology at night.

Mechanized olive harvesting often entails large machines that shake or envelop trees with large rakes or brushes. However, shaking could pose challenges to a tree’s root structure, while older, more irregularly-shaped olive trees may not fit inside the body of a mechanical harvester. Using a robotic vacuum might allow for more versatility.

The arrival of automated harvesting could have a dramatic impact on the seasonal labor force of the largest olive oil producers.

In Spain, unemployment rose to 18.8 percent in the first quarter of 2017, while Italy and Greece currently have rates around 11.3 and 21.7 percent, respectively. These countries have also seen large influxes of economic migrants and refugees in recent years, increasing competition for jobs in labor-intensive industries like agriculture.

As a result, the cost of seasonal labor in olive harvesting will probably be kept relatively low for Mediterranean producers in the near-term, making large-scale capital investments in robotics unlikely for all but the largest agricultural firms in the region.

In the United States, fruit and nut farms currently employ roughly 41 percent of the country’s agricultural workers, or almost 200,000 people. Of this figure, one-sixth of the workforce is comprised of migrants. However, anti-immigration pressures and increases to the minimum wage could force producers to accelerate the deployment of agricultural technologies in the United States as the costs of capital and labor reach parity.

As robots in the field continue to advance and more competitors enter the marketplace, the price for automated harvesters will become increasingly competitive. For olive oil producers who depend on speed and efficiency to press, bottle, and deliver a high-quality product to their customers, the optimal price point for a robot that can work day and night with near-perfect accuracy may arrive sooner than later.