In Chile, Mixed Expectations Replace High Hopes

Chile anticipates a decline in olive oil production in 2024 due to factors such as lack of rainfall and climatic instability. Despite challenges, producers in central Chile are expecting a similar harvest to the previous year, while those in northern Chile face a significant decrease in production due to a lack of irrigation.

Officials and producers in Chile anticipate a production decline in 2024, citing a lack of rainfall in the north and climatic instability at the moment of flowering in the spring.

According to data from ChileOliva, a producers’ association, the second-largest producing country in the Americas yielded 21,000 tons of olive oil in 2023, which aligns with the five-year average.

Gabriela Moglia, ChileOliva’s general manager, confirmed that production was likely to fall in the country in 2024, adding how the harvest will unfold from now until July remains uncertain.

During late 2023, there had been optimism that production would increase. In its November estimate, the International Olive Council forecasted that production could reach 24,500 tons in 2024.

See Also:2024 Harvest UpdatesIn an October interview, José Pablo Illanes, the general manager of Las Doscientos, also expressed confidence for the 2024 harvest.

However, he caveated that summer weather conditions (summer runs from December through March in the Southern Hemisphere) would play a significant role in determining the harvest, and they have.

“The harvest planned for 2024 is less than what was harvested in 2023,” Illanes said. “The expected decrease is 20 percent. This is due to multiple factors, such as the tree’s old genetics, excess rainfall in winter and climatic instability during the flowering dates of November 2023.”

Las Docientos cultivates 700 hectares of olives in the Maule Valley, about three hours south of Santiago.

Illanes said the significant rainfall in the region during the winter alleviated the drought by refilling dams and the Pencahue Canal. However, the rain has also inundated the soil in the company’s groves.

“The biggest challenge this year was dealing with excess water in the soil,” he said. “The countryside’s soils are mainly clays with poor drainage, so excess water accumulates in the low areas and damages the trees.”

Expectations ahead of the harvest differ slightly for Olivos del Sur, Chile’s largest olive oil producer, with 2,500 hectares of olive groves.

Ismael Heiremans, the country’s agricultural manager, said the harvest in the country’s center looks similar to last year’s.

“The climatic conditions of El Niño during the winter allowed for good water supply and a calm season in terms of water resources,” he said.

While El Niño continues, Heiremans expects more rain in central Chile and a lower likelihood of an early frost, another significant challenge producers face each year.

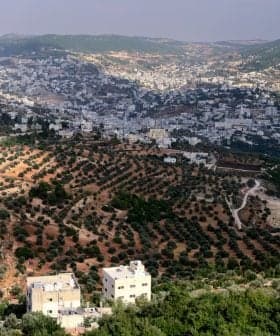

Chile’s largest olive oil producer expects an average harvest in the center but a sharp decline in northern Chile. (Photo: Olivos del Sur)

However, the same does not apply to the company’s olive groves in northern Chile. A lack of rainfall in Coquimbo, about 400 kilometers north of Santiago, meant the company could not provide enough irrigation to its trees at the precise moments during fruit development when water is needed the most.

“Since the precipitation was zero millimeters, and the supply issue is very complex… there is between 40 and 60 percent less than the last harvest, especially in the Arbequina variety, which also suffered greatly due to the lack of chill hours and did not allow it to flower correctly,” Heiremans said.

Producers anticipate the harvest to begin at the end of April. As a result, the situation could continue to change based on the weather.

“The main condition for having a good amount of oil between now and harvest is the stability of irrigation, given that all oil generation is just beginning,” Illanes said.

Despite the lower fruit this year, he expects the 45-day harvest to be more efficient after the company invested in new equipment.

Away from the harvest, producers and exporters in Chile continue to navigate the complicated global olive oil market as high prices at origin do not necessarily compensate for rising production costs.

Paula Gajardo, Olivos del Sur’s export manager, said that some Chilean producers are benefiting as major European bottlers seek out new suppliers in South America to make up for shortfalls caused by another poor harvest in Spain and other parts of the Mediterranean.

“This generalized shortage has raised prices, almost tripling those seen two to three years ago,” she said. “On the one hand, this has created space for Chilean exports and Olisur, in particular, as a producer.”

“On the other hand, as olive oil prices rose, Olisur also experienced an increase in costs and, therefore, implemented an increase in its prices,” Gajardo added.

Gajardo worries that consumers in Chile and abroad will only be able to tolerate higher olive oil prices for so long before they begin to shift toward other grades of olive oil, such as virgin or refined, or to other edible oils.

“The extra virgin olive oil industry is experiencing a complex time, and there are few signs of recovery at the moment,” she concluded.