Italian Production in 2019 Exceeds Initial Estimates

Italian olive oil production reached 365,000 tons, an increase of 110 percent compared to 2018 and 25,000 tons higher than initial estimates. Consumption, imports and exports also increased.

Italian olive oil production in the 2019/20 crop year was higher than expected at nearly 365,000 tons, with significant increases in the south and decreases in the north. The increase in production led to a decrease in prices, with Italian olive oil prices falling by 44 percent in the first quarter of 2020 compared to the previous year.

Italian olive oil production in the 2019/20 crop year amounted to nearly 365,000 tons, a higher total than previously expected, according to the latest report by the Institute of Services for the Agricultural and Food Market (Ismea).

Based on declarations that were provided by mills up until mid-March, when harvesting operations were concluded, the 2019 yield is more than double the volume of the previous year.

The national output has returned to good levels and, even though it is far from being considered abundant, the growth figures are relevant.

“The national output has returned to good levels and, even though it is far from being considered abundant, the growth figures are relevant,” Tiziana Sarnari, the Ismea market analyst, told Olive Oil Times.

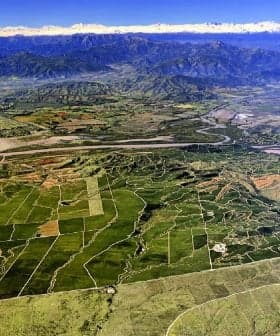

“On the basis of the data analyzed, the peninsula can be divided into two parts: the north with drastic reductions that in some cases have led to almost zero volume, and the south with increases in all regions, some of which have doubled or tripled the poor yield of the previous years.”

See Also:2019 Harvest NewsPuglia, which usually accounts for half of national production but suffered from severe frosts last year, recovered to the normal output and recorded 208,755 tons.

In Calabria, volumes more than tripled (+284 percent) compared to the previous crop year, exceeding the average of the last four years by a large margin. Meanwhile, production in Sicily returned to normal levels, with 34,000 tons.

Basilicata also registered a huge increase in production (+412 percent). Large increases were also experienced in Campania and Sardinia, while more modest gains have been recorded in Lazio, Marche, Abruzzo, and Molise.

On the other hand, Tuscany, Umbria, Emilia Romagna and Friuli Venezia Giulia all experienced production decreases in 2019.

However, the sharpest decline was recorded in Trentino Alto Adige (-98 percent), followed closely by Lombardy (-91.7 percent), Veneto (-91.2 percent), Piedmont (-88 percent) and Liguria (-71.6 percent) – areas which account for a small percentage of the national production.

In response to these data, Italian olive oil prices in the first quarter of 2020 followed a downward trend, decreasing by 44 percent compared with the same period last year (falling from €5.61/$6.08 per kilogram to €3.10/$3.36).

“The abundant stocks at the beginning of the campaign, especially in Spain, has driven down international prices,” Sarnari said, pointing out that in Italy the decline had intensified in early summer and persisted until the autumn, with the opening of the mills and the expectation of a reasonable production.

According to the report, Spain also registered a 21 percent drop in prices, which fell to €2.13 ($2.31) per kilogram, compared to €2.68 ($2.91) at the same time last year.

“This decrease in prices, which were already particularly attractive, has allowed bottling companies to buy at affordable rates both in Italy and abroad, and so far, despite the current situation due to the Covid-19 crisis, they do not seem to have supply problems,” the Ismea analyst said.

The stocks were, therefore, effective in offsetting the slight decrease in world olive oil production.

According to the latest estimates by the International Olive Council, Spain suffered a considerable decline in production, recording a 35 percent decrease compared with 2018.

On the other hand, Greece experienced an increase, although production was lower than expected at the beginning of the harvest. Tunisia and Turkey also experienced production increases.

“Over the last two months, as mills gradually ended their activity, the market has gone through a more reflective phase, in which bottling companies are in no hurry to buy, while the producers wait for more favorable prices,” Sarnari said.

She added that private storage aid is also having an impact on prices.

Moreover, based on data received from the Italian National Institute of Statistics (Istat), Ismea indicates that for 2019, Italian olive oil and pomace imports have exceeded 600,000 tons at an expenditure of €1.4 billion ($1.52 billion).

While this figure represents a 9.5 percent increase in volume, it is also a 13 percent decrease in spending, due to the reduction in international prices.

Exports also increased slightly in volume, reaching 339,000 tons, but only amounting to €1.37 billion ($1.48 billion) in value, a decrease of 8.5 percent.

The abundant availability of Spanish olive oil helped to meet growing Italian demand as olive oil consumption also grew by 26 percent.

Meanwhile, imports from Greece and Tunisia decreased. Exports to the United States remained stable, while those to Germany, France and the United Kingdom grew.

“We have to wait a few weeks, when the situation concerning the health crisis will be more defined in Italy, Spain, Greece and Tunisia,” Sarnari said, adding that in the coming months producers and exporters would have to face the uncertainty of the U.S. tariffs and the implementation of Brexit.

“Now, however, the issue of the global health crisis still remains, and the time and ways to get back to normal will be crucial to understand the development of trade,” Sarnari concluded.