CEO of Largest Olive Oil Company Calls the Industry's Business Model 'Broken'

Pierluigi Tosato spoke today to a group representing major importers and said the industry was going about it all wrong.

Pierluigi Tosato

Pierluigi TosatoThe executive chairman of Deoleo, S.A., Pierluigi Tosato, stated that the olive oil industry’s business model is broken due to falling consumption and overproduction, addressing attendees at a conference near Chicago. Tosato criticized protectionist practices, lack of consumer trust, and the use of olive oil as a loss leader by retailers, calling for a unified global standard and sustainable production to combat the industry’s challenges.

The executive chairman of the world’s largest olive oil company said today that the business model for the olive oil industry was “broken,” and the next few years will be critical as consumption slumps in traditional markets and a scenario of overproduction with dwindling demand looms.

Consumption is falling because consumers have a lack of confidence and they don’t trust anything.

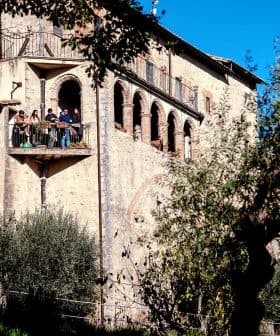

Pierluigi Tosato was addressing the 50 or so attendees of a conference near Chicago organized by the North American Olive Oil Association, most of whom had been in the olive oil business far longer than the featured speaker.

Tosato joined Deoleo as its chief executive just two years ago, bringing a beverage industry background to lead the company that produces the Bertolli, Carapelli and Carbonell brands.

“Consumers are moving away from olive oil,” Tosato declared in his opening remarks. “We will have an excess in production in the next years. The demand is not going the way it should go.”

Dressed in jeans and sneakers, the CEO of the Spanish multinational denounced what he said were the protectionist practices that have damaged the industry and caused consumer mistrust.

“Consumption is falling because consumers have a lack of confidence and they don’t trust anything,” Tosato said, using his native country, Italy, as an example. “There is not enough olive oil [made in Italy] no matter what they say. They try to [disparage] imports but by doing that they have harmed the category.”

Aside from producing countries badmouthing imports, Tosato sees private brands and retailers using olive oil as a loss leader as major factors driving the sector downward.

“In Spain, internal demand dropped, the market is dominated by private label. Olive oil is perceived as a traffic builder by the retailers and of course, volume is more important than value. And the retailers are asking only for a promo price because they see the category as a traffic builder — nothing more than that.”

Tosato presented some slides of what appeared to be typical olive oil sections in grocery stores. “I’m coming from other categories. This is really bad,” he said to the group representing companies who filled those shelves.

“There’s something we have been doing wrong in this category for many, many years, sorry to say,” said Tosato, who ran a bottled water business, Acqua Minerale San Benedetto, and was presumably used to better-looking displays.

And while the olive oil sector has been banking on U.S. consumers to catch on to the product and reverse the bleak trends in traditional markets, Tosato implied it was little more than a mirage, for now.

“So far we have very little consumption per capita, but the private label is growing. This is driving the profitability of the category down. So [the U.S.] is following the same path as Spain and Italy. Is that good? I don’t think so.”

After condemning private labeling to a room full of private labelers, Tosato wasn’t through. Next on his list was the lack of a unified global standard for the category.

“Even though we are dealing with a unique product, fantastic product, in my opinion, we are confusing the consumers. We are just confusing them. There is no formal standard — it’s a mess,” he said.

“The European Union has its own rules, International Olive Council has standards, but Australia has its own, and in the U.S. there is no standard — no common rules, nothing. And in this vacuum, the bad guys are winning. The bad guys are transforming this industry into a commodity. Because we don’t talk to each other. We don’t trust each other,” he said.

“Olive oil is a broken business model. We need to change it.”

He laid out his company’s roadmap that included offering incentives to farmers for producing better fruit and harvesting earlier. “We need to support sustainable production, not only super-intensive. Traditional production is giving jobs to local communities, which is fine.”

Tosato called for an agreement on one set of global standards, whatever they may be, and he defended the role of organoleptic assessment for certifying quality. “This is the best way to defend olive oil for the future.”

Finally, he said, “We need to fight like hell against the bad practices. This is a bad industry.”

After his speech, he presented a short video in which the CEO sat in an olive field and said, “We have been facing attacks and a lot of fake news on the internet. We are denying all these allegations and what we want to do is come up in front of consumers and show them exactly what we are doing.”