Olive Oil is Becoming One of Asia’s Most Popular Ingredients

The Asia-Pacific olive oil market is projected to grow at a rate of 4.2 percent annually from 2020 to 2025, making it a popular ingredient in the region, despite local consumers preferring imported oils. Chinese consumers value imported olive oils for their quality and safety standards, with the country importing the majority of its olive oil from Spain.

According to market research firm Mordor Intelligence, the Asia-Pacific olive oil market is estimated to grow at an annual compounded rate of 4.2 percent from 2020 to 2025.

This puts the Mediterranean diet staple on pace to become one of the region’s most popular ingredients.

Extra virgin olive oil consumption in China is increasing at a significant pace, particularly in big cities and in a segment of the population aged 25 to 30 that has traveled abroad.

However, evidence suggests that local consumers still prefer imported olive oils, despite the continent’s producers making enormous strides to improve their product and win awards in international competitions.

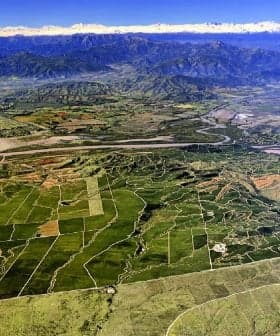

See Also:Trade NewsPablo Canamasas is an Argentinian agronomic engineer who produced Longnan Xiangyu Olive Development Company’s robust Picholine, which earned a Gold award at the 2017 NYIOOC World Olive Oil Competition.

He told Bloomberg News that locally-produced olive oils in China are not recognized at home as they are abroad.

“Crazy as it may sound, the Chinese public has the same view we outsiders have on Chinese products: that they are of poor quality,” he said.

In June 2019, the Direct China Chamber of Commerce (DCCC) reported that Chinese consumers valued the quality and high food safety standards associated with imported oils more than those produced domestically.

At the time of the study, China imported 90 percent of its olive oil from Spain, and consumers said they were more than willing to pay the premium for the imported product.

The International Olive Council estimates that olive oil consumption in China in the 2020/21 crop year will reach 66,000 tons, up from 57,500 tons in 2018/19. Of that total, China imported 58,500 tons and produced 7,500 tons.

See Also:Geographical Indications Protected in China‑E.U. Trade Deal“Extra virgin olive oil consumption in China is increasing at a significant pace,” Canamasas said. “Particularly in big cities and in a segment of the population aged 25 to 30 that has traveled abroad and is more exposed to the Mediterranean diet or has heard of it.”

According to the DCCC, consumers’ preference for imported oils has been partially fueled by lower olive oil prices in Europe and tariff reductions for Italian olive oil imports.

The chamber highlighted that Italy, Greece and Tunisia have adapted quickly to evolving Chinese eating habits, including local consumers’ increasing awareness of healthy diets and evolving cooking trends.

Along with these factors, China’s growing middle class also was credited for the growing trend.

According to Bloomberg News, the increasing popularity of olive oil in Asia has also spurred producers in the region to make more olive oil.

Japan’s olive oil exports rose to 276 tons in 2019, increasing 209 percent compared to 2018 and 545 percent compared to 2014.

Japanese producers also enjoyed a record year at the 2020 NYIOOC, earning eight accolades, including four Gold awards.