Europe's Olive Oil Exports on Record-Breaking Pace

European Union olive oil exports are expected to reach a record 820,000 tons in the 2019/20 crop year, with significant increases seen in key markets like Brazil, the United Kingdom, and the United States. Despite the high export volumes, low prices mean that the value of these exports did not match the volume, and imports are also expected to reach a historic high in the same crop year, driven by E.U. processing and re-exporting needs.

European Union olive oil export volumes are on pace to reach a new record in the 2019/20 crop year, according to the Director General of Agriculture and Rural Development’s short-term market outlook report for autumn 2020.

From October 2019 through July 2020, exports grew significantly and are on pace to reach 820,000 tons. According to data from the International Olive Council, the previous record was achieved in the 2018/19 crop year, when the bloc exported 647,600 tons.

These increasing flows (of imports) are driven by both E.U. processing and re-exporting needs, which helps to sustain business relations in certain export destinations where some E.U. exports are restricted due to retaliation tariffs.

Export volumes increased to every single one of the E.U.’s main olive oil destinations, including a 32 percent increase in shipments to both Brazil and the United Kingdom (which formally left the E.U. on January 31, 2020), a 16 percent increase to the United States and three percent increases to both Japan and China.

Combined, these five countries account for about 70 percent of all the olive oil exports from the 27-member trading bloc.

See Also:Trade NewsHowever, persistently low olive oil prices throughout the E.U. mean that the value of these exports did not match the volume. The value of olive oil exports to the United States fell by about three percent and dropped by 10 percent to both Japan and China in 2019/20.

Along with exports, olive oil imports could also reach a historic high, with the E.U. expected to bring in 240,000 tons in the 2019/20 crop year. The previous import record stood at 231,800 tons in the 2003/04 crop year.

Almost 90 percent of these imports are expected to come from Tunisia, which is expecting to achieve record exports in 2019/20.

“These increasing flows are driven by both E.U. processing and re-exporting needs, which helps to sustain business relations in certain export destinations where some E.U. exports are restricted due to retaliation tariffs,” the authors of the report wrote, referring to the imposition of a 25 percent tariff by the United States on packaged Spanish olive oil imports in October 2019.

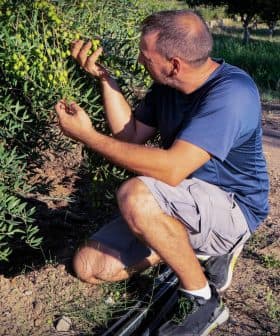

See Also:Some Signs Suggest Better Outlook for Greek FarmersWhile both exports and imports are expected to soar as the crop year comes to a close, olive oil consumption is anticipated to increase by three percent in the E.U.

The increase is mostly fueled by “strong consumption by households,” which the report attributed to lockdowns imposed by most of Europe to curb the spread of the Covid-19 pandemic and comes in spite of reduced demand from the restaurant and hospitality sectors.

“Together with an anticipated export growth, it should contribute to a stock reduction of 20 percent,” the report said.

Producers across the sector have long held that rising consumption and exports paired with a decrease in the massive glut of olive oil stocks will help prices recover across the bloc.

Looking ahead to the 2020/21 crop year, the report predicts that olive oil production in the E.U. will reach 2.2 million tons, a 17 percent increase compared with the previous crop year.

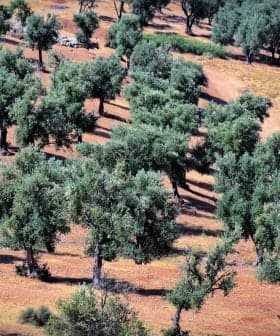

See Also:Early Estimates Point to Lower Production in ItalySpain is expected to lead the way with 1.55 million tons, followed by Italy and Greece with an estimated 290,000 tons and 280,000 tons, respectively. Meanwhile, production in Portugal is estimated to reach 100,000 tons.

Due to the record-high exports of the current crop year and existing stocks in many of the world’s largest olive oil consuming nations, exports are expected to dip again in 2020/21. The report forecasts that the E.U. will ship 790,000 tons abroad. As a result, imports are also expected to fall.

However, olive oil consumption is expected to continue increasing. The report forecasts a 3.5 percent rise in consumption in 2020/21, fueled both by the continuing growth of domestic demand paired with the slow recovery of the restaurant and hospitality sector.