Despite Drop in Production and Exports, Moroccan Producers Remain Optimistic

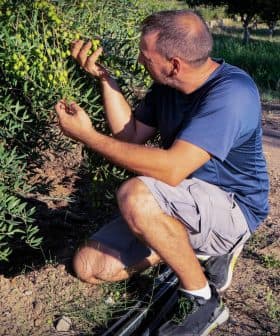

Morocco is expected to be the fifth largest producer of olive oil in the 2020/21 crop year, with an estimated production of 140,000 tons, a slight decline from previous years. Despite challenges such as increased operating costs due to Covid-19 measures, the country’s olive oil production continues to rise, with a focus on expanding exports to Europe and the United States.

Morocco is on pace to be the fifth largest producer of olive oil in the 2020/21 crop year, according to data published by Juan Vilar Strategic Consultants.

The North African country is expected to produce 140,000 tons of olive oil in the current crop year, a slight decline compared to the previous year and 60,000 fewer tons than the record-breaking harvest in 2018/19.

I think the current strategy of focusing on two major markets – the U.S. and E.U. – with our current production is the right first step.

In spite of the consecutive years of decline, olive oil production in Morocco continues to trend upward, mostly due to a government initiative to plant more olive trees.

However, Noureddine Ouazzani, the head of the producer association, Agro-Pôle Olivier Meknès, warned that plenty of challenges still lie ahead for Moroccan olive farmers.

See Also:2020 Harvest UpdatesOuazzani told the local news agency Agrimaroc that Covid-19 containment measures will bring overall operating costs up since they dictate how many workers may be present at one time and control their movement across regions.

In a separate interview with La Vie Eco, Ouazzani said workers would normally commute to the groves in crowded transport trucks, but as a result of the virus, transportation costs would likely double or triple.

He also emphasized how increasing costs for producers are also due to the low level of mechanical innovation in the fields and mills.

Over the last dozen years, the Moroccan government has focused on promoting the olive oil and table olive production sectors. Since 2008, olive production has risen from 662,000 tons to 1.56 million tons, in 2018.

The number of olive groves in the country has also grown substantially and is set to reach three million acres (1.2 million hectares) in 2030.

Along with increasing production, another prong of the Green Morocco Project – a strategy meant to boost the country’s entire agricultural sector – is the promotion of Moroccan exports.

Currently, Morocco exports about two billion dirham ($218 million) worth of olive oil and table olives each year.

In an average year, roughly one-third of these exports are shipped north across the Mediterranean to ports in Italy and Spain.

However, exports to the 27-member trading bloc have fallen by 64 percent compared with the 2018/19 crop year and 40 percent compared with the rolling five year average, according to data published by the European Commission.

The combination of a lower-than-expected harvest in 2019, the Covid-19 pandemic and a bumper crop in Tunisia have all been blamed for diminishing exports to Europe, which is the largest single destination for Moroccan olive oil.

However, Ali Belaj, a Moroccan olive oil producer and sommelier, told Olive Oil Times that Moroccan olive oils remain in high demand in Europe and he expects these exports to bounce back.

“I would not say that exports to the E.U. were directly affected by an increase in Tunisian production,” he said. “Tunisia has olive oil that is fantastic, that said Morocco’s footprint in the E.U. is very significant with a long history.”

His belief is shared by the rest of the Moroccan government, which has received 11.6 billion dirham ($1.26 billion) of public and private investment from the E.U. to bolster its production.

Away from the E.U., Belaj said that Moroccan producers are increasingly concentrating on the North American market, with a recently-launched government initiative to promote Moroccan olive oil in the United States.

“I think the current strategy of focusing on two major markets – the U.S. and E.U. – with our current production is the right first step,” he said. “However, Asia is another big potential market, as their consumers are starting to change their habits and use more olive oil, but all in due time.”